WASHINGTON – Today, in a coordinated action with the U.S. Department of Justice, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) took action against six Nigerian nationals for conducting an elaborate scheme to steal over six million dollars from victims across the United States. The individuals designated today targeted U.S. businesses and individuals through deceptive global threats known as business email compromise (BEC) and romance fraud. American citizens lost over $6,000,000 due to these individuals’ BEC fraud schemes, in which they impersonated business executives and requested and received wire transfers from legitimate business accounts. Money was also stolen from innocent Americans by romance fraud, in which the designees masqueraded as affectionate partners to gain trust from victims.

“Cybercriminals prey on vulnerable Americans and small businesses to deceive and defraud them,” said Secretary Steven T. Mnuchin. “As technological advancement increasingly offers malicious actors tools that can be used for online attacks and schemes, the United States will continue to protect and defend at-risk Americans and businesses.”

Malicious actors are exploiting the increased availability of online tools and technology to target at-risk Americans. The six individuals designated today manipulated their victims in order to gain access to usernames, passwords, and bank accounts in furtherance of the scheme. Several of those who engaged in romance fraud used online tools, including social media and email, to further their social engineering tactics.

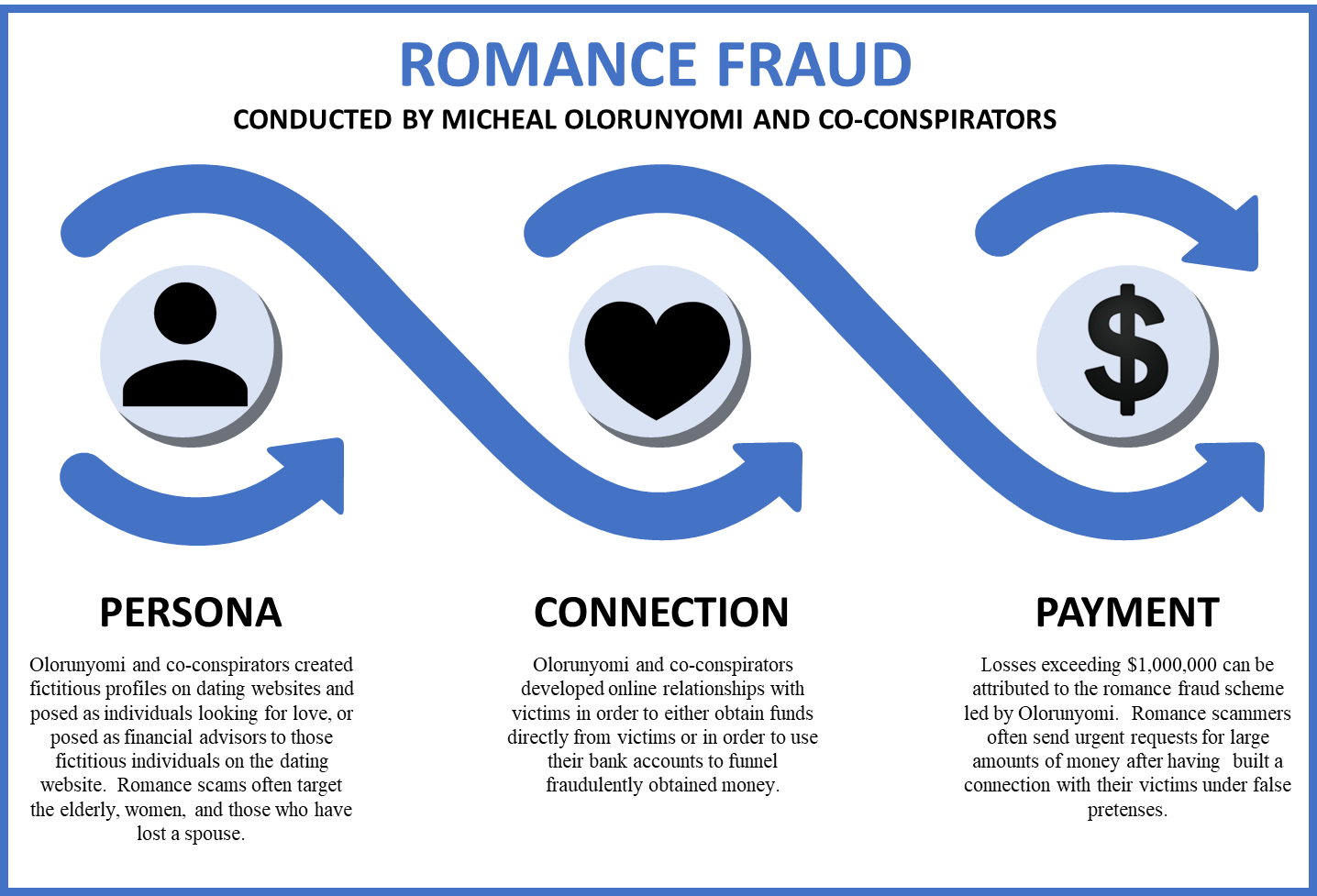

OFAC closely coordinated with the Federal Bureau of Investigation (FBI), which today released details regarding its indictment against members of the conspiracy. The FBI Internet Crime Complaint Center (IC3) receives romance fraud victim reports from all ages, education, and income brackets. However, the elderly, women, and those who have lost a spouse are often targeted.

E.O. 13694 SANCTIONS

Today’s action includes the designation of six individuals pursuant to Executive Order (E.O.) 13694, as amended by E.O. 13757, which targets malicious cyber-enabled activities, including those related to the significant misappropriation of funds or economic resources for private financial gain.

As a result of today’s action, all property and interests in property of the designated persons that are in the possession or control of U.S. persons or within or transiting the United States are blocked, and U.S. persons generally are prohibited from dealing with them.

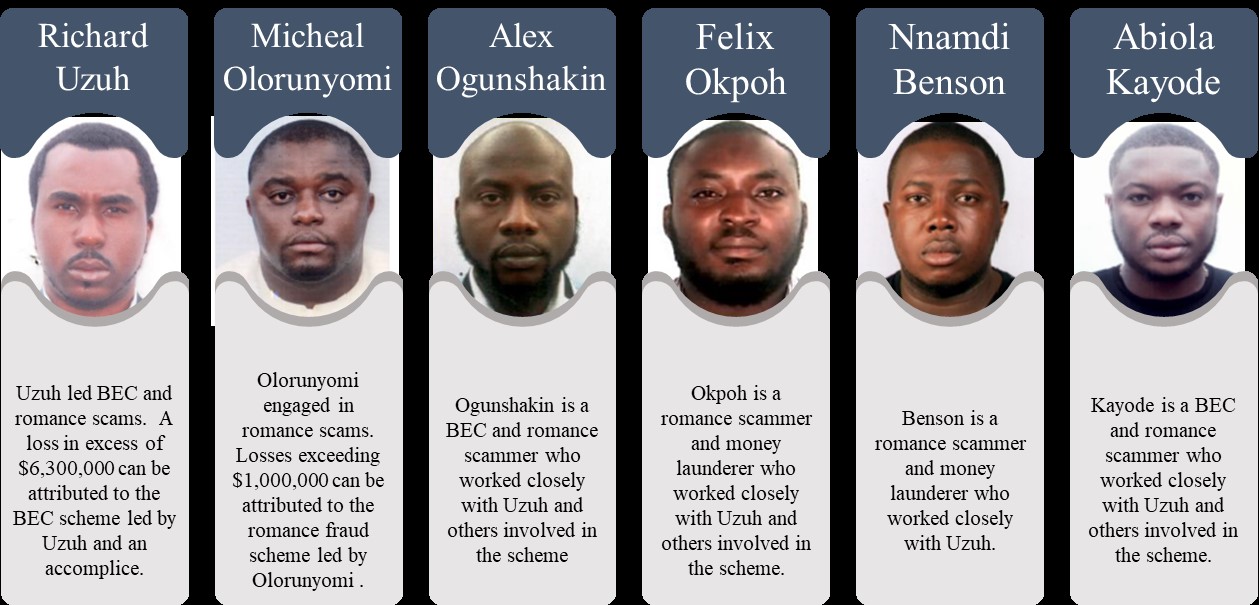

Richard Uzuh (Uzuh) was designated pursuant to E.O. 13694, as amended, for having engaged in cyber-enabled activities that have the purpose or effect of causing a significant misappropriation of funds or economic resources for private financial gain.

From at least early 2015 to September 2016, Uzuh and an accomplice sent emails to victims appearing as though they were coming from a company’s true business executive, and would request and receive wire transfers of funds from the businesses’ accounts. Uzuh would often target over 100 businesses in a single day. A loss in excess of $6,300,000 can be attributed to the BEC scheme led by Uzuh and an accomplice.

Micheal Olorunyomi (Olorunyomi) was designated pursuant to E.O. 13694, as amended, for having engaged in cyber-enabled activities that have the purpose or effect of causing a significant misappropriation of funds or economic resources for private financial gain.

From September 2015 to June 2017, Olorunyomi and an accomplice led a scheme that victimized Americans through the use of romance fraud. Olorunyomi and his co-conspirators created fictitious profiles on dating websites and posed as individuals looking for love. He developed online relationships with victims to either obtain funds directly from victims, or used their bank accounts to funnel fraudulently obtained money. Losses exceeding $1,000,000 can be attributed to the romance fraud scheme led by Olorunyomi and his accomplice.

Alex Ogunshakin (Ogunshakin) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support for Uzuh.

Ogunshakin conducted BEC and romance scams. Ogunshakin provided Uzuh and other co-conspirators with bank accounts that were used to receive fraudulent wire transfers. Additionally, Ogunshakin assisted Uzuh with contacting victim companies and he conducted his own BEC schemes.

Felix Okpoh (Okpoh) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Okpoh conducted romance scams and engaged in money laundering, working closely with Uzuh and others involved in the scheme. Okpoh provided hundreds of U.S. bank accounts that were used to receive fraudulent wire transfers from victims of BEC and romance fraud.

Nnamdi Benson (Benson) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Benson conducted romance scams and money laundering, working closely with Uzuh. Benson communicated with multiple romance fraud victims to obtain their bank account details, and provided the account information to Uzuh to receive fraudulent wire transfers from U.S. businesses.

Abiola Kayode (Kayode) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Kayode conducted BEC and romance scams, working closely with Uzuh and others involved in the scheme. Kayode provided U.S. bank accounts to individuals involved in the scheme, one of which was then used to receive a $69,150 fraudulent wire transfer.

Identifying information on the individuals and entity designated today.

Treasury is committed to responding to evolving online threats that target organizations and individuals in the United States. In July 2019, Treasury’s Financial Crimes Enforcement Network (FinCEN) released an advisory noting that it received over 32,000 reports involving almost $9 billion in attempted theft from BEC fraud schemes targeting U.S financial institutions and their customers since its 2016 advisory. In another ongoing effort, recovered funds through FinCEN’s Rapid Response Program, in collaboration with law enforcement, recently surpassed $920 million. Under the program, when U.S. law enforcement receives a BEC complaint from a victim or a financial institution, the relevant information is forwarded to FinCEN, which moves quickly to track and recover the funds.

For more information regarding BEC scams and romance fraud, please see the July 2019 FinCEN Advisory, the July 2019 FinCEN Financial Trend Analysis Report, and the FBI IC3 Public Service Announcement.