Banks participating in the Small Business Lending Fund will benefit from the incentives the Fund provides for increased lending. The more the bank increases its small business lending, the lower the rate it will receive. The application deadline C corporation banks and savings associations is May 16, 2011. Applications should be submitted to SBLFApps@treasury.gov. For questions specific to your institution, please email SBLFInstitutions@treasury.gov. For general questions, please call the information line at 888-832-1147.

The application deadline for Subchapter S corporations and mutual institutions is June 6, 2011. Separate terms apply for Subchapter S corporations and mutual institutions. For information specific to these institutions, please refer to the Overview for Subchapter S Corporations and Mutual Institutions.

How the Small Business Lending Fund Works

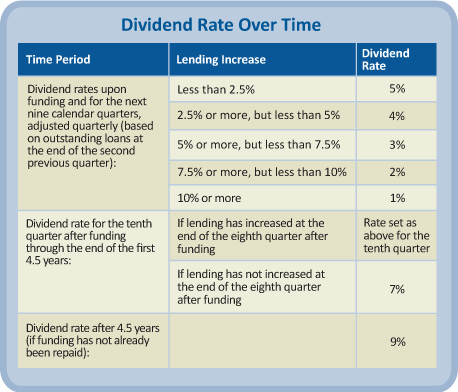

For C corporation banks and savings associations, Treasury will provide a bank with capital by purchasing Tier 1 qualifying preferred stock or equivalents. To encourage community bank participation, the cost of capital will start no higher than 5%. If a bank’s small business lending increases by 10% or more, then the rate will fall as low as 1%.

Banks that increase their lending by amounts less than 10% can benefit from rates set between 2% and 4%. If lending does not increase in the first two years, however, the rate will increase to 7%. After 4.5 years, the rate will increase to 9% if the bank has not already repaid the SBLF funding.

The Small Business Lending Fund also provides an option for community banks to refinance preferred stock issued to Treasury through the Capital Purchase Program (CPP) or the Community Development Capital Initiative (CDCI) under certain conditions. However, simultaneous participation in CPP or CDCI and SBLF is not permitted.

Qualified Small Business Lending

The Small Business Jobs Act defines small business lending as certain loans of up to $10 million to businesses with up to $50 million in annual revenues. Those loans include:

- Commercial and industrial loans

- Owner-occupied nonfarm, nonresidential real estate loans

- Loans to finance agricultural production and other loans to farmers

- Loans secured by farmland

- Eligibility

Your institution is eligible if it has assets of $10 billion or less and it meets the other requirements for participation. If your institution is controlled by a holding company, the combined assets of the holding company determine eligibility and your holding company must apply.

If your institution has total assets of $1 billion or less, it may apply for SBLF funding that equals up to 5% of its risk-weighted assets. If your institution has assets of more than $1 billion, but less than $10 billion, it may apply for SBLF funding that equals up to 3% of its risk-weighted assets

Restrictions

An institution is not eligible if it is on the FDIC problem bank list (or similar list) or has been removed from that list in the previous 90 days. Generally, this will include any bank with a CAMELS rating of 4 or 5.

An institution seeking to refinance CPP or CDCI securities through SBLF must be current on its dividend payments to the Treasury, cannot have previously missed more than one dividend payment, and must fully refinance or repay its CPP or CDCI securities. For more information, please refer to the Requirements for CPP or CDCI Refinancing page.

Repayments

With the approval of your institution’s regulator, your institution may exit the Small Business Lending Fund at any time simply by repaying the funding provided along with any accrued dividends. If your institution wishes to repay its SBLF funding in partial payments, each partial payment must be at least 25% of the original funding amount.

Application

Please refer to the The Application Process page.

Resources for C Corporation Banks and Savings Associations

Fact Sheet

Getting Started Guide

Application Form and Instructions

Lending Plan Form and Guide

Supplemental Reporting Requirements

Summary of Preferred Terms

Summary of Preferred Terms for CPP or CDCI Refinancing

Frequently Asked Questions