Luke Bassett, Director of Policy and Program Impact

Chris Sun, Director of Data

Since January 1, 2024, buyers of eligible new and pre-owned clean vehicles have been able to choose to receive the full value of the Inflation Reduction Act’s (IRA) clean vehicle tax credits at the time they purchase their clean vehicles from a registered dealer rather than waiting to claim the credit on their tax returns. The tax credit can be as high as $7,500 for new vehicles or $4,000 for pre-owned vehicles, and it may be applied as a downpayment equivalent to the purchase of the vehicle.

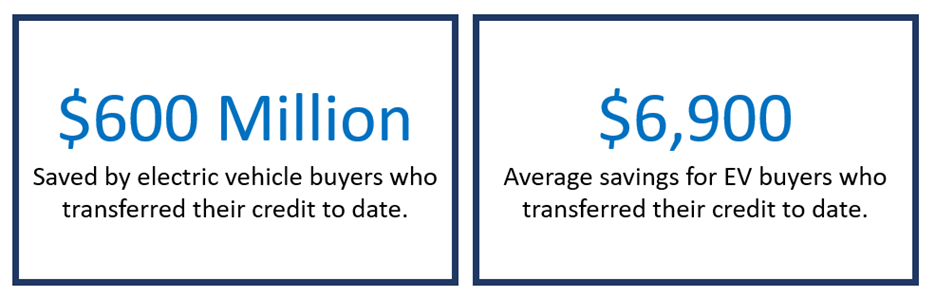

To date, buyers of these qualified clean vehicles have been able to collectively save over $600 million at the time-of-sale as a result of these tax credits, an average of $6,900 per sale.[1] Buyers who are switching to an electric vehicle could also save up to $14,500 over a 15-year lifespan compared to the average gasoline-powered vehicle.[2] These are economic benefits that many Americans are realizing now thanks to the credits in the IRA and the work of the IRS and IRS Energy Credits Online.

In addition to putting money back into the pockets of American taxpayers, these IRA credits are also accelerating the transition to a clean passenger vehicle market. In2023, which was the first full year that the IRA’s clean vehicle credits were in effect, the sale of electric vehicles in the U.S. increased 50% compared to the previous year. And that transition is only expected to continue as U.S. electric vehicle sales are forecasted to grow a further 30% in 2024.[3]

Learn more about the IRA’s clean vehicle credits, its savings for Americans, and its impact on the broader vehicle market below.

The IRA provides tax credits for qualified clean vehicles

The IRA provides new opportunities for eligible consumers to save money on clean vehicles, offering incentives for the purchase of qualifying new (§ 30D) or pre-owned (§ 25E) electric vehicles, plug-in hybrid vehicles, and fuel cell vehicles. There are dozens of vehicle models that qualify for these credits. More information about eligible models can be found on FuelEconomy.gov.

To qualify, prospective buyers must buy the vehicle for their own use, not for resale. In addition, the buyer’s modified adjusted gross income (AGI) must be under certain thresholds. More information about these requirements can be found on IRS.gov for new, and pre-owned vehicles.

Unlike other tax credits, eligible buyers can receive an immediate reduction in the cost of the vehicle at the point of sale rather than waiting until filing their taxes. Buyers purchasing a new or pre-owned clean vehicle from one of the more than 10,000 participating dealerships can choose to have the value of their tax credit applied toward their purchase.

To date more than 100,000 clean vehicle Time of Sale Reports have been submitted through IRS Energy Credits Online, including more than 15,000 for pre-owned vehicles. Each of these Time of Sale Reports represents a buyer that is potentially saving thousands of dollars on an eligible clean vehicle purchase thanks to the Inflation Reduction Act.

Prospective buyers can learn more about these credits by visiting the IRS ( English | Español ), the Information for Consumers one-pager, the IRA Resource Hub, or by viewing the infographic below.

The IRA is saving money for average Americans

The savings that clean vehicle buyers can expect are not just limited to the time of purchase either. By transitioning from a traditional gas powered vehicle to an electric vehicle, buyers can potentially save thousands annually in lower fuel and maintenance costs.

Based on a report by the U.S. Department of Energy’s (DOE’s) National Renewable Energy Laboratory (NREL), the typical American driver saves nearly $8,000 on fuel costs over 15 years by driving an electric vehicle instead of a similar one fueled by gasoline, and potentially as much as $14,500. (See Figure 1 below)

Figure 1. Source:“Levelized Cost of Charging Electric Vehicles in the United States.” DOE/NREL

These estimated lifetime fuel cost savings are likely to increase as clean vehicle efficiency and technology improves over time.

The IRA is supporting the clean vehicle transition

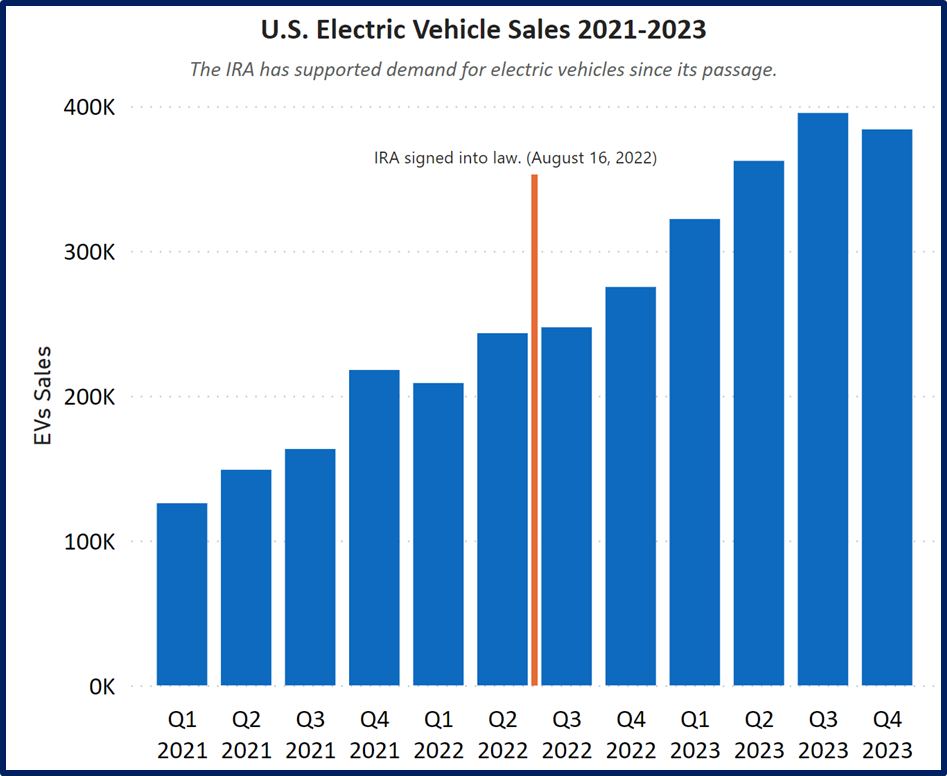

One of the key goals of the IRA is to stimulate the development and demand for a clean vehicle industry that would reduce the U.S.’s reliance on fossil fuel vehicles. Since the passage of the IRA in August 2022, the U.S. has experienced historic shifts in the transition to clean vehicles. The U.S. in 2023 saw 1.46 million passenger clean vehicle (battery electric, fuel cell, plug-in hybrids) sales—the highest annual total ever. That figure also represents a 50% year-over-year increase from 2022.

Figure 2. Source: Treasury analysis of BloombergNEF EV Sales data

And this acceleration is happening broadly in the passenger vehicles market, allowing American consumers more choice and accessibility. The IRA has supported demand across the board that automakers are competing to fill. For example, six of the top 10 U.S. electric vehicle makers in 2023 saw sales increase by over 50% compared to 2022, and three of those saw sales increase by over 90%.

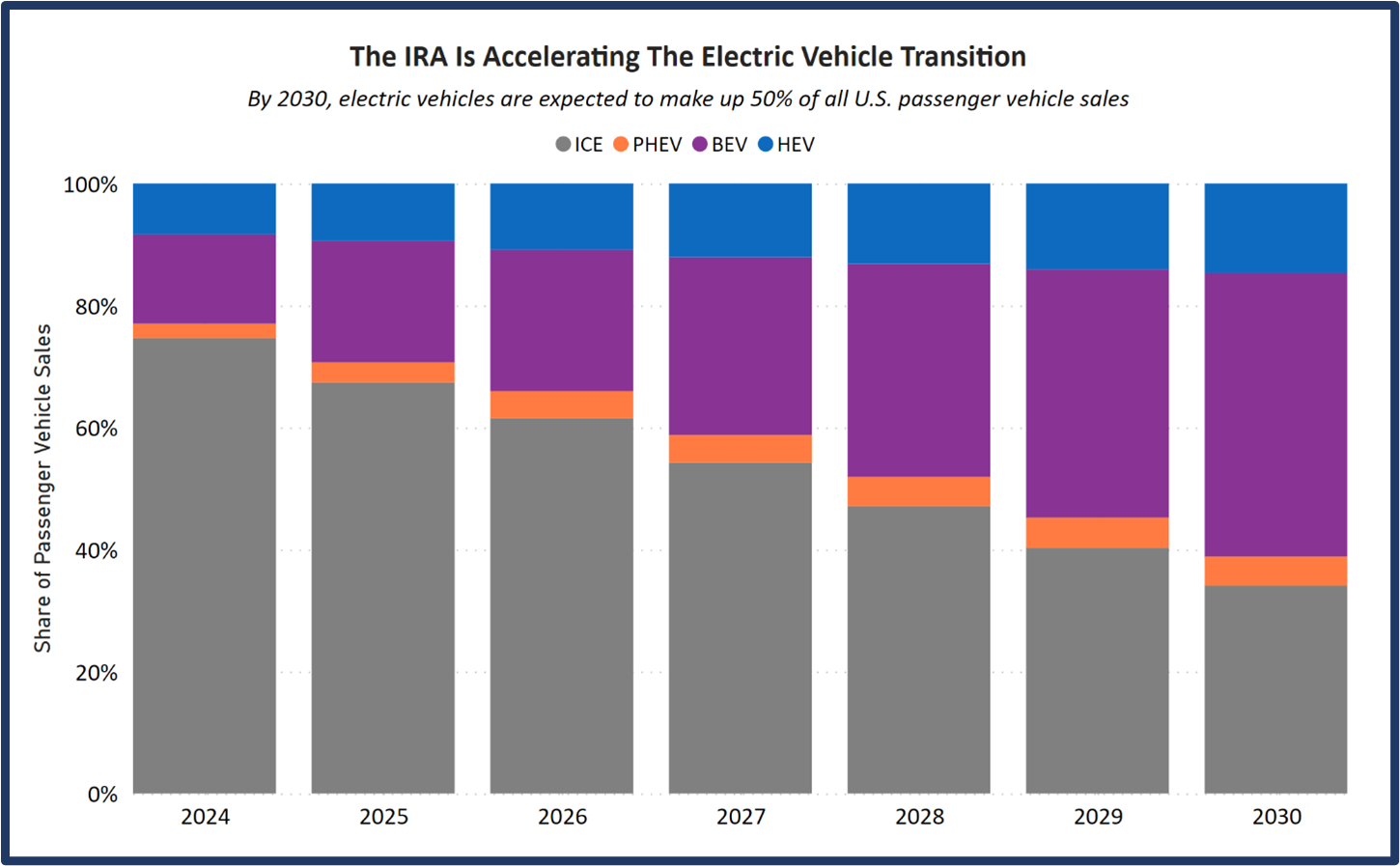

Over the long-term, this transition is expected to continue as more IRA clean vehicle credit qualifying vehicles are produced and sold in the U.S. According to recent research by Bloomberg,[4] U.S. electric vehicle sales are forecast to grow a further 30% in 2024, totaling 1.9 million units sold. And by 2030, battery electric and plug-in hybrid vehicles are forecast make up over 50% of total U.S. passenger vehicle sales (see Figure 3).

Figure 3. Source: Treasury analysis of BloombergNEF EV Sales Outlook data

Conclusion

The new and pre-owned clean vehicle tax credits made available by the IRA are already saving eligible buyers of qualified vehicles thousands of dollars, with total savings amounting to well over $600 million. At the same time, these tax credits are supporting the market for clean vehicles in the U.S. with dramatic sales increases in 2023 and laying the foundation for continuous and increased uptake in the years to come.

[1] Based on data from the Internal Revenue Service’s Energy Credits Online (ECO) portal. Since January 1, 2024.

[2] “Levelized Cost of Charging Electric Vehicles in the United States.” DOE/NREL

[3] BloombergNEF Electric Vehicles Sales – 2022-2023 and EV Sales Outlook 2024

[4] BNEF: Electrified Transport Market Outlook 1Q 2024