Eric Van Nostrand, P.D.O. Assistant Secretary for Economic Policy

Laura Feiveson, Deputy Assistant Secretary for Microeconomics

Yesterday, the Bureau of Labor Statistics reported that median weekly real earnings—that is, earnings that have been adjusted for inflation—rose in the second quarter of this year by 0.8 percent, or 3.3 percent at an annual rate. This solid increase continues to reflect an improvement in the purchasing power for the median worker since before the pandemic and is good news for American households.

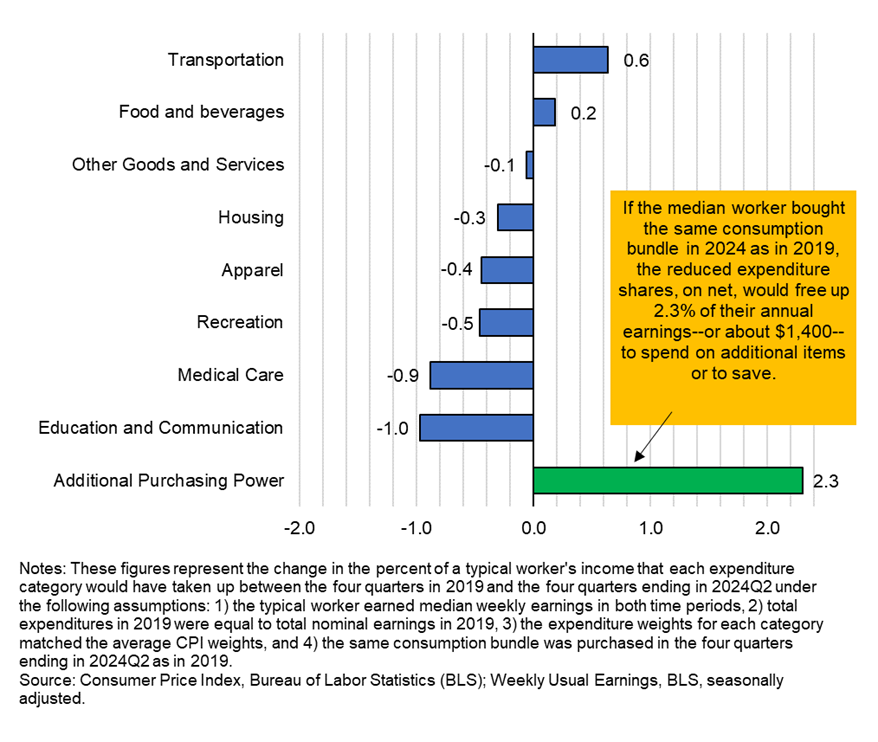

We incorporated the new earnings data, along with consumer price data through the second quarter, into the analysis of our December blog post on the purchasing power of American households. The new data continues to show that income has risen more than prices since before the pandemic—the typical middle-class worker has seen their real weekly earnings rise 2.3 percent since 2019.1 We find that in the year ending in the second quarter of 2024, the median American worker could afford the same goods and services as they did in 2019, plus an additional $1,400 to spend or save per year.

Figure 1: Expenditure Share of Median Earnings, Change from 2019 to 2024

1 This update uses seasonally adjusted data and four-quarter moving averages to smooth through quarterly fluctuations. The prior analyses had used four-year changes, comparing non-seasonally adjusted data in 2023 to their equivalent quarter in 2019.