(Archived Content)

2006-3-3-11-8-29-23998

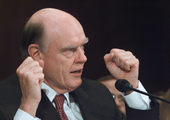

Stanford, Calif. – In a speech to an economic summit at the Stanford Institute for Economic Policy Research (SIEPR) Friday morning, Treasury Secretary John Snow discussed the importance of keeping tax rates lower on individuals and investment capital: By lowering the taxes on capital, the Jobs and Growth Act of 2003 encouraged increased long-term investment. Increased long-term investment in turn improved the long-turn outlook of the economy. It made the economy more productive. With additional capital, labor output rose. And with rising labor output the demand for labor increased and living standards are now higher. And while many factors contributed to the improved performance of the economy, the tax reductions on capital, I think, have been at the heart of the progress we have seen. … Making those tax cuts permanent will help keep our economy on this good path of growth.

###