Chairman Wyden, Ranking Member Crapo, Members of the Committee: Thank you for inviting me to share these views on the international aspects of business tax reform. International tax reform feeds into our most important tax policy goals: building a tax system that is fit for purpose, fair, and focused on the needs of all Americans.

In my testimony today, I will discuss several crucial issues related to international tax reform. First, we need better protections to defend the U.S. corporate tax base from the tax-motivated shifting of corporate profits to offshore havens. Second, international tax reform is an essential ingredient in building a fairer tax system. Third, it is important to modernize our tax system to better suit a globally integrated economy, reducing the tax preference in favor of foreign operations, and enabling U.S. workers to compete on a level playing field. Most important, all our tax system choices must serve the interests of all Americans.

Fortunately, there are relatively straightforward changes that we can make, that will vastly improve our international tax regime. These include a stronger, more robust minimum tax and steadfast work with our partners and allies abroad in order to counter the pressures of international tax competition.

Building a Tax System that Is Fit for Purpose

International tax reform is essential to our most important tax policy goals. After the tax cuts of prior years, we now raise only about 16 percent of GDP in federal tax revenue. (To put this into perspective, the last time the U.S. balanced the federal budget, receipts were about 20 percent of GDP.) And, while the pandemic necessitated a large and robust fiscal response in the near term, it will be important to build a tax system that can contribute to our many important fiscal priorities, including lasting investments in infrastructure, research, and clean energy. At the same time, it is essential not to raise taxes on typical workers, who have often not felt the beneficial effects of our strong economic growth.

Compared to our trading partners, the U.S. government raises very little corporate tax revenue. For many years, the typical OECD (Organization for Economic Cooperation and Development) country has raised about 3 percent of GDP from corporate taxation, whereas in 2018 and 2019 (before the pandemic occurred), the United States raised only 1 percent of GDP from the corporate tax. Even before the 2017 Tax Cuts and Jobs Act, the United States was below peer nations, collecting only 2 percent of GDP. Indeed, corporate taxes as a percentage of GDP have been trending downwards in the United States since the 1950s.[1]

Corporate Tax Revenues Relative to GDP

|

|

United States |

OECD Average[2] |

|

Post TCJA: 2018/2019 |

1.0 |

3.1 |

|

5 Years pre TCJA: 2013-2017 |

2.0 |

2.9 |

|

Years Prior: 2000-2012 |

2.0 |

3.0 |

Data Source: OECD Revenue Statistics

Corporate tax revenues are low despite the fact that U.S. companies produce very high corporate profits, both in historic and comparative terms. For example, in recent years, corporate profits (after-tax) as a share of GDP averaged 9.7 percent (2005-2019), whereas in the period 1980-2000, corporate profits averaged only 5.4 percent of GDP.[3]

Indeed, the U.S. corporate sector is the most successful in the world; the United States hosts 37 percent of the Forbes Global 2000 top companies’ profits, despite the fact that the United States only comprises 24 percent of world GDP and less than 5 percent of the world’s population.[4]

Yet, despite the enormous success of the corporate sector, U.S. companies continue to shift corporate profits offshore, reducing the U.S. corporate tax base and U.S. tax revenues. As of 2017, corporate profit shifting by both U.S. and foreign multinational companies cost the U.S. government approximately $100 billion per year at prior tax rates.[5] Although revenue loss is mechanically lower at today’s lower corporate income tax rates, recent data indicate that the role of foreign tax havens was quite similar in 2018 and 2019 as it was in the years before the 2017 law.

Although the 2017 law contained two modest measures that were supposed to reduce profit shifting (the GILTI minimum tax, for global intangible low-tax income, and the BEAT, for base-erosion anti-abuse tax), the 2017 law also encouraged profit shifting in other ways, by exempting from U.S. taxation the first ten percent return on foreign assets, and by taxing foreign profits at half the rate of U.S. profits.

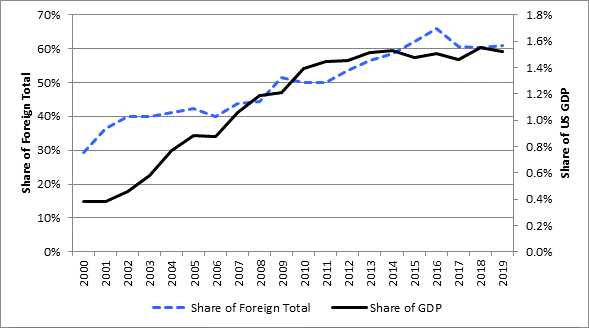

The Share of U.S. Multinational Corporation Income in Seven Big Havens, 2000-2019

Note: Data are foreign investment earnings data from the U.S. Bureau of Economic Analysis. The seven low-tax jurisdictions that are particularly important in these data are: Bermuda, the Caymans, Ireland, Luxembourg, the Netherlands, Singapore, and Switzerland. The haven share is mechanically higher than it would be in some data sources since the data are reported on an after-tax basis.

Based on the early evidence in the two years after the law, the use of tax havens to avoid tax continues unabated. As the figure above illustrates, the share of total foreign income in seven prominent tax havens is nearly identical in the two years after the law (2018 and 2019) as it was in the five year prior to the law, at 61 percent of after-tax income, or 1.5 percent of GDP.

Building a Fairer Tax System

Improving international taxation will do more than raise much-needed revenue. It will also improve the progressivity of our tax system, ensuring that large corporations—and those that own them—pay their fair share.

The corporate tax is one of the most progressive taxes in our tax system, far more progressive than the individual income tax or the payroll tax. Economic models from organizations as varied as the U.S. Treasury, the Joint Committee on Taxation, the Congressional Budget Office, the Tax Policy Center, and the American Enterprise Institute all agree that the vast majority of the corporate tax burden falls on the owners of capital and those with excess profits.

Recent decades have witnessed a worrisome increase in economic inequality, combined with a falling labor share of income. At the same time, governments throughout the world have too often responded by shifting relative burdens away from capital, reducing tax rates on capital gains, dividends, and corporate income, while increasing relative tax burdens on other income. Instead of dampening economic inequality, the tax system has too often exacerbated it. In part, these policy changes may have been a response to the fact that capital is more mobile than labor, as it is easier to offshore a factory (and even easier to offshore paper profits) than it is to move a person (or their labor income).

Yet policy-makers have not sufficiently modernized the tax system to make it more suited to these global forces. The changes outlined below will go much further toward that end. It is also essential to remember that shifting the capital tax burden to individuals, rather than businesses, will still leave much capital income untaxed, unless long held tax preferences are completely rethought. At present, about 70 percent of U.S. equity income goes untaxed by the U.S. government at the individual level.[6] (Indeed, some U.S. equities are also held by foreigners, whose residence countries may or may not tax that income at home. When corporate rates are cut, large benefits accrue to foreign investors.)

In addition to enhancing the progressivity of the U.S. tax system, the corporate tax is also efficient, since taxing excess profits can generate revenue without undue distortion, and evidence indicates that a rising share of the tax base, now likely over three quarters, is comprised of excess returns.[7] Finally, a majority of voters in both parties favor higher taxes on corporations.[8]

Building an Economy that Meets the Needs of All Americans

Our modern global economy generates enormous churn. Forces such as transformative technological change, rising market power, import competition, declining unionization, and changing social norms have left many workers with economic outcomes that fall short of long-held expectations. Nearly 90 percent of children born in the 1940s out-earned their parents, but that share has fallen steadily. For children born in 1970, only 60 percent out-earn their parents; for those born in the 1980s, only half do.[9]

Those left behind by economic disruption are looking for answers. Some policy solutions, such as reinvigorating labor law to give workers greater economic power and investing in infrastructure and community colleges in left-behind regions, can be quite helpful. Others, such as erecting immigration barriers, risk adding insult to injury. Immigration is a vital source of job creation and innovation in the U.S. economy; turning our back on immigrants and foreign students weakens one of our most essential advantages.[10]

Yet we can do a lot more to ensure our tax system works for American workers. Expanding the earned income tax credit rewards work for those that are struggling, and expanding the child tax credit is an enormous anti-poverty tool. Both of these were enacted as part of the American Rescue Plan. In corporate tax, it is important to reduce the large tilt in the playing field that favors foreign income and to work with partner countries to lessen the pressures of tax competition. A stronger minimum tax, stronger measures to tackle the profit shifting of foreign multinational companies, and close cooperation with our allies all have an important role to play.

Building a 21st Century Tax System

The American Rescue Plan provided an essential down payment, expanding child tax credits and earned income tax credits, both measures that go to the heart of creating inclusive, worker-focused prosperity. But we also need to build business tax systems that can handle the global mobility of capital.

Multinational corporations can reasonably be asked to pay their fair share. At present, U.S. corporations pay income tax at only a 21 percent rate, a lower marginal tax rate than that faced by many schoolteachers and firefighters.[11] Multinational companies operating offshore receive even more favorable tax treatment. Under the GILTI minimum tax, the first ten percent return on tangible assets is completely free of U.S. tax, and subsequent income is taxed with a 50 percent deduction, facing tax at approximately half the full U.S. rate.[12] Our tax system would benefit from a much stronger minimum tax.

Building Multilateral Cooperation in International Tax

We are not alone in worrying about the profit shifting of multinational companies. Since 2013, there has been an ongoing international effort at cooperation in this area, led by the OECD and G20 countries, referred to as BEPS (for base erosion and profit shifting). The first round of negotiations made some modest progress in several areas, but ultimately was not transformational, as tax avoidance techniques that were shut down sprung back in different forms, and multinational company profit shifting continued in a manner similar to years prior.

Presently, a second round of negotiations is centered around addressing two problems: rethinking the allocation of taxing rights in a modern economy (so called “Pillar One”), and ensuring that all companies pay some minimum level of tax (“Pillar Two”). Within these efforts, a country-by-country minimum tax is presently being proposed internationally.

In general, there is strong policy interest in solving these vexing international tax problems, and countries’ efforts can be mutually reinforcing. For instance, governments levying minimum taxes generate positive fiscal spillovers for each other’s tax bases, by substantially reducing the incentive of their resident multinational companies to shift profits away from all non-haven tax bases toward tax havens. Further, U.S. leadership in international tax reform may incentivize stronger action abroad.

Working with our allies and friends in order to build better tax laws can help nations cooperate to solve other global collective action problems, not just stopping excessive tax competition pressures in corporate tax, but also using these vital international collaborations to work productively to handle issues like climate change, global public health, and other serious threats.

Building Consensus

Several hurdles stand in the way of international reforms, but they are not insurmountable.

Concerns about the competitiveness of U.S. multinationals ignore the evidence. Both before and after the 2017 Tax Act, U.S. multinational companies are the envy of the world, not just for their high profits and market capitalization, but also for their tax planning acumen. U.S. multinational companies paid similar effective tax rates as peers in other countries, even before the 2017 Tax law dramatically lowered U.S. corporate tax rates. And, U.S. corporate tax revenues are far lower than those in peer countries, as shown in the table above.

Further, to the extent that foreign countries also adopt strong minimum taxes, that will also reduce any competitiveness worries, while protecting our tax base from the profit shifting of foreign multinational companies. In fact, the present moment is an ideal time to reform our international tax rules, since there is a strong international consensus around addressing these problems, and our action can encourage action abroad.

Finally, it is important to remember that competitiveness is about more than the success of U.S. companies in foreign merger and acquisition bids. It is also about ensuring that our tax code doesn’t incentivize foreign operations at the expense of those at home. And, it is about nurturing the many fundamental strengths that make the United States a good place to do business. Investing in our institutions, in the abilities, education, and economic power of American workers, in the quality of our infrastructure, and in cutting-edge research is all important. It is also important to work harmoniously with other countries in order to ensure a smooth and stable trading system, and in order to seriously address common concerns such as climate change and public health.

[1] Data from Tax Policy Center. “Corporate Income Tax as a Share of GDP, 1956-2018.” https://www.taxpolicycenter.org/statistics/corporate-income-tax-share-gdp-1946-2018

[2] The average for G7 countries is very similar.

[3] Data are from the Federal Reserve Economics Statistics database.

[4] Data are from 2020 Forbes Global 2000 list.

[5] See Clausing, Kimberly. “Profit Shifting Before and After the Tax Cuts and Jobs Act.” 2020. National Tax Journal.73(4). 1233-1266. My preferred estimate is over $100 billion, but a thorough analysis that employs four data sources and three methods finds a wide range of revenue costs; across all methods, the revenue cost averages about $90b per year. Similar revenue losses are found in Clausing, Kimberly. “Five Lessons on Profit Shifting from the U.S. Country by Country Data.” 2020. Tax Notes Federal. 169(6). November. 925-940. Many other researchers have drawn attention to the large scale of the profit shifting problem. Studies are too numerous to fully recount here but include Guvenen, Fatih, Raymond J. Mataloni, Dylan Rassier, and Kim J. Ruhl. 2018. “Offshore Profit Shifting and Domestic Productivity Measurement.” NBER Working Paper No. 23324; Crivelli, Ernesto, Michael Keen, and Ruud A. de Mooij. 2016. “Base Erosion, Profit-Shifting, and Developing Countries.” Finanz - Archiv 72 (3): 268–301; and Bilicka, Katarzyna. 2019. “Multinationals’ Profit Response to Tax Differentials: Effect Size and Shifting Channels.” American Economic Review 109 (8): 2921–2953.

[6] See Burman, Leonard E., Kimberly A. Clausing, and Lydia Austin. 2017. “Is U.S. Corporate Income Double-Taxed?” National Tax Journal 70 (3): 675–706.

[7] See Laura Power and Austin Frerick. 2016. “Have Excess Returns to Corporations Been Increasing Over Time?” National Tax Journal. 69 (4): 831–46.

[8] See data from the Financial Times-Peterson Foundation U.S. Economic monitor, summarized at https://www.pgpf.org/infographic/majority-of-voters-support-higher-taxes-for-wealthy-and-corporations-and-want-next-president-to-pay-for-his-priorities.

[9] See Raj Chetty et al. “The Fading American Dream: Trends in Absolute Income Mobility Since 1940.” Science. 28 April 2017. 398-406.

[10] For a book length treatment of these themes, see Clausing, Kimberly. Open: The Progressive Case for Free Trade, Immigration, and Global Capital. Cambridge: Harvard University Press, 2019.

[11] In 2020, the 22 percent tax bracket began at $40,126 for single individuals.

[12] The exact rate depends on the circumstance of the company. If they are operating only in zero-tax jurisdictions, they pay tax at 10.5 percent, but the rate can be as high as 13.125 percent if income is blended with income from higher-tax countries, since foreign tax rates are only 80 percent creditable.