Chairman Thompson, Chairman Pascrell, Ranking Member Smith, Ranking Member Kelly, and Members of the Subcommittees: Thank you for inviting me to discuss tax compliance and the Administration’s tax compliance agenda. Improving tax compliance can help meet our Nation’s most important tax policy goals: building a tax system that raises adequate revenue in an equitable and efficient manner.

The Internal Revenue Service (IRS) has endeavored to estimate the amount of non-compliance with the Federal tax system since at least the 1970s. The Taxpayer Compliance Measurement Program (TCMP) was the foundation for these early efforts. In the early 2000s, the IRS launched the National Research Program (NRP) to estimate non-compliance in a more rigorous way. The NRP also instituted procedures to reduce the burden on taxpayers whose tax returns were randomly selected to be part of the study. The main focus of the NRP is compliance with the individual income tax and self-employment taxes, but additional components examine compliance with other taxes.

The Research, Applied Analytics, and Statistics organization in the IRS regularly produces a measure of tax non-compliance, called the “tax gap”. This term is defined as the amount of true overall tax liability that is not paid voluntarily and on time. There are three main subcategories of the tax gap (or non-compliance): filing compliance (whether a tax return was filed on time); reporting compliance (whether the correct amount of tax liability was reported on the tax return filed); and payment compliance (whether the taxpayer completely paid the tax liability shown on the return). Each of these components of compliance (or non-compliance) is estimated for each of the major taxes imposed by the Federal government. When summed up, they provide an estimate of the overall tax gap. For 2011-2013, the IRS estimates the gross tax gap to average $441 billion per year. When enforcement collections and other late payments are taken into account, the average annual net tax gap is estimated to be about $381 billion for the 2011-2013 time period.

If we project the IRS annual tax gap estimate from 2011-2013, assuming that it grows with the overall economy, the estimate of the gross tax gap would be about $580 billion for 2019. Over the coming decade, the gross tax gap is projected to total approximately $7 trillion, roughly 15 percent of all owed taxes. Tax non-compliance has serious consequences for the majority of Americans who pay their taxes in full each year. A larger tax gap generates the following results: higher tax rates elsewhere in the system, lower revenues to fund the nation’s fiscal priorities, or higher budget deficits and larger amounts of federal debt. Extensive and persistent non-compliance also undermines confidence in the fairness of our tax system.

In part, the large and growing tax gap is the result of a sustained period of under-investment in the IRS. The IRS budget has been reduced by about 20 percent in real terms over the last decade. Since the IRS budget largely covers personnel, staffing dropped and there was a steep decline in audit rates. The IRS has had insufficient resources to meet enforcement and administrative challenges and to deliver customer service to taxpayers.

The Administration’s Fiscal Year 2022 Budget and the American Families Plan propose a transformative investment in the resources and information available to the IRS. The plan has several key components.

First, provide the IRS the resources it needs to address tax non-compliance and serve taxpayers. A sustained, multi-year funding stream would provide nearly $80 billion in additional resources to the IRS over the next decade. Treasury has worked with the IRS to make sure that resources and staffing will grow at a pace that can be smoothly absorbed. The mandatory nature of the vast majority of this funding will provide the certainty required to make investments in high-quality tax enforcement staff who have the skills, knowledge, and training required to understand the complicated tax situations of corporations, partnerships, and high-income individuals. Multi-year funding certainty also enables key investments with large fixed costs, such as modernizing information technology, building a strong human capital office, and assembling talented research teams.

Second, invest in better IRS technology systems to help identify non-compliance and improve customer service. The IRS too often relies on antiquated and siloed technology systems. Modernization funding would allow the IRS to address technology challenges, develop innovative machine learning techniques to better detect non-compliance, and support efforts to meet threats to the security of the tax system, like the 1.4 billion cyberattacks the IRS experiences annually. These technology improvements would also help the IRS overcome taxpayer service challenges, allowing taxpayers to communicate with the IRS in a clear, timely manner. Improved IT and taxpayer service will also help the IRS effectively and efficiently deliver tax benefits to eligible households.

Third, improve information reporting to give the IRS better information on opaque sources of income. When the IRS can verify taxpayer filings with third-party information reports, such as the W-2 forms submitted by employers to report wages, income reporting compliance rates exceed 95 percent. Without third-party reporting, income reporting compliance rates can fall below 50 percent. Strengthening third-party reporting is one of the most effective ways to improve tax compliance, and Congress has repeatedly extended information reporting requirements as business practices changes and as technology improves. These changes have been effective. To ensure new reporting does not create additional burden on individual taxpayers, the Administration’s proposal would call for financial institutions to report known account information to the IRS and the taxpayer, in particular providing information about total account outflows and inflows to financial accounts. The IRS will use this new information to better target enforcement activities, detecting obvious areas of gross non-compliance and decreasing the likelihood that fully compliant taxpayers will be subject to audit. Under the enhanced information reporting, voluntary compliance will rise, as taxpayers realize that the IRS has an additional lens into previously underreported income streams. This new information reporting regime will be comprehensive, and so the proposal envisions that it would cover payment services providers as well as cryptocurrencies and cryptoasset exchange accounts.

Fourth, undertake complementary proposals to improve tax administration. The FY 2022 Budget includes several additional important measures related to tax administration. One proposal calls for IRS to have the ability to regulate paid tax preparers. Taxpayers often make use of unregulated preparers who can lack the training and knowledge to provide accurate tax assistance. Regulation of paid preparers can help improve the accuracy of tax returns filed. In addition, the Budget calls for additional sanctions for so-called “ghost preparers” who fail to identify themselves on the tax returns which they prepare.

Together, these proposals would provide many benefits: raising about $700 billion in revenue over the course of a decade, creating a fairer tax system, building a more efficient tax system, and improving taxpayer service.

Revenue Effects

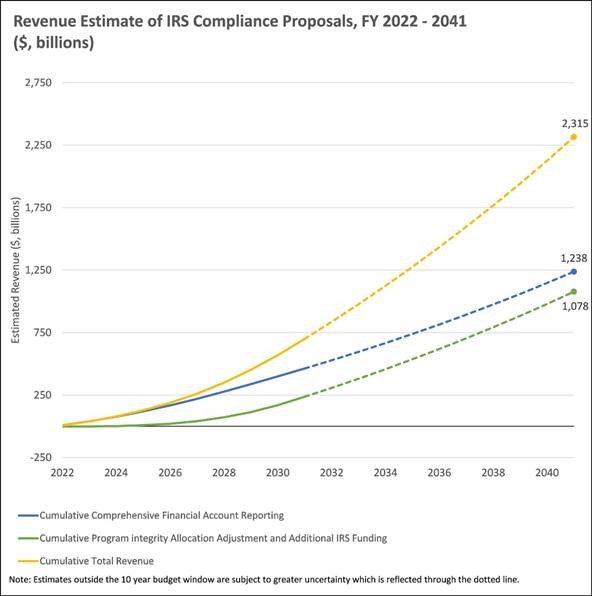

Treasury’s Office of Tax Analysis estimates that these compliance initiatives would raise about $700 billion in additional tax revenue over the next decade. These estimated revenues are largely raised in the latter years of the 10-year budget window as investments in staffing and technology will take time to build and become fully productive. As Figure 1 shows, the estimated amount of revenue raised in the second decade from these compliance initiatives is more than twice what is estimated to be raised in the first decade.

The proposal for additional IRS funding is estimated to raise about $240 billion of net revenue over the ten-year budget window. These estimates are based on historic data from the IRS on the return on investment (ROI) from its various enforcement activities. The total gross revenue generated from the $80 billion increase in the IRS budget over the next 10 years is estimated to be around $320 billion for the same period, which implies an average ROI of approximately 4-to-1.

In several respects, these estimates tend to be conservative. The revenue potential for additional resources devoted to tax administration is based on ROI estimates from the IRS for current enforcement-related activities. Potential benefits from overhauling and integrating IT systems and improving taxpayer service are omitted from these calculations. In addition, estimates for additional enforcement actions supported by increased IRS funding cover only the additional tax payments generated and do not incorporate deterrent effects, which may be significant.

Figure 1: Estimated Revenue Raised from Compliance Initiatives, 2022–2040

The amount of increased revenue estimated to be raised by the proposed financial reporting regime requires some assumptions about implementation. Once the proposal is enacted, we would expect an increase in voluntary compliance as taxpayers realize that the IRS has a lens into previously unreported income. The revenue and voluntary compliance increases are expected to phase-in over time, as taxpayers and the IRS adjust to the new reporting regime. The proposed information reporting regime is expected to become effective for tax year 2023, as it will require time for the IRS and for financial institutions to implement this reporting system in ways that maximize effectiveness. The proposed financial reporting system is estimated to raise about $460 billion over the coming decade.

A Fairer Tax System

As noted above, the tax gap has three distinct elements: taxpayers who fail to file returns (about 9 percent of the gross tax gap); those who underreport income or overclaim deductions or credits on tax returns (about 80 percent of the gross tax gap); and those who underpay taxes despite reporting obligations in a timely manner (about 11 percent of the gross tax gap).

Underreporting is the biggest component of the tax gap generally grows with actual economic income. In part, non-compliance rises with income because higher-income taxpayers have access to more sophisticated forms of noncompliance, and this sophisticated activity is harder for the IRS to detect. Even more important, higher-income taxpayers are more likely to have sources of income that are less visible to the IRS.

For typical wage and salary income, where employers provide a Form W-2 to both employees and the IRS (as well as automatically withhold income taxes), income reporting compliance is very high, with only an estimated 1 percent misreporting rate. But, when there is less third party reporting, compliance falls. For opaque income sources like proprietorship income and rental income, income misreporting is estimated to be over 50 percent.

The Administration’s financial reporting initiatives will provide the IRS with new information related to opaque income sources. This information will help the IRS direct audit resources toward those taxpayers whose financial situations are mismatched with their reported income. The information reporting proposal would also improve voluntary compliance as taxpayers come to understand that the IRS has additional information about their true financial situation.

The goal is to improve the fairness of the tax system by treating all types of income, whether business income or wage income, more similarly. The requested enforcement resources largely would be directed at the complex tax returns of high-income individuals and the businesses they control, both of which have seen sharply reduced audit rates in recent years. In particular, under the FY 2022 Budget proposal, audit rates for taxpayers below $400,000 in true income would not increase relative to recent years.

One important stream of research has begun to identify disparities in tax enforcement activities. Historically, this inquiry has been complicated by the absence of data on taxpayers’ race or ethnicity. The Biden Administration recently launched an Equitable Data Working Group that seeks to address these data limitations across federal datasets. At the same time, the Treasury Department is currently undertaking research to study the relationship between the tax code and racial inequities. This multi-year project will require close engagement between federal agencies and those in the research and advocacy communities. The Biden Administration’s commitment to racial equity was a key factor affecting how these policies are implemented.

A More Efficient Tax System

Collecting more tax revenue by closing the tax gap improves the efficiency of the tax system in several ways. First, a broader tax base can raise more revenue than a narrow one, holding tax rates constant. When noncompliant taxpayers shirk their tax obligations, that raises the relative tax burden on compliant taxpayers. Second, when some types of income can more easily escape taxation than others, the allocation of resources in the economy is inefficiently distorted toward some sectors and away from others. In effect, these distortions make the tax-evading sectors too large and the tax-compliant sectors too small relative to a more neutral treatment. Third, tax non-compliance also distorts competition between taxpayers in any given industry. For example, consider one business that pays their taxes honestly, but competes against another business that evades most of their tax burden by underreporting income. The dishonest business will have an unfair advantage relative to the honest business. And similar distortions will occur as taxpayers over-invest in non-compliance techniques including complex organizational forms that have little relation to efficient business operations, reducing the resources available for more economically productive activities.

Building a Better Tax Administration System

The Administration’s tax compliance proposals are complementary, and they will work together to create a more efficient and equitable tax administration. When the IRS is adequately funded, it will be able to better process all the information it receives. With improved information reporting, the IRS will be able to better utilize its enforcement resources. Similar complementarities exist between well-trained enforcement personnel and modern information processing systems.

The Administration’s proposals will also improve most taxpayers’ experiences. Adequate staffing and technology are essential for taxpayers to communicate effectively and efficiently with the IRS, getting questions answered in a timely fashion, easing access to appropriate tax benefits and tax refunds, and generally facilitating a smoother filing process. Taxpayers also will be able to interact with the IRS to ensure that their accounts are kept up-to-date. And improved systems will make it less likely that compliant taxpayers get swept up in burdensome audit processes.

Since most of the newly-requested funding will be allocated in a multi-year manner, that will assure the IRS that it will have the resources required to invest in long-deferred technology modernization. The IRS will also be able to invest in building staffing capacity. Once these proposals are enacted, regular reporting on milestones and performance metrics will be essential in order to evaluate progress in closing the tax gap.

We all believe that taxpayers should pay the amount of tax that they legally owe under the laws enacted by Congress. Today, there is a large gap between that belief and the tax compliance reality we observe. The compliance proposals contained in the Administration’s FY 2022 Budget can take important steps toward narrowing that gap. We look forward to working with Congress to address this long-standing problem.

###