Updated FinCEN Advisory Highlights Iranian Oil Smuggling, Shadow Banking, and Weapons Procurement Typologies

WASHINGTON — Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) is designating over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam, who have collectively laundered billions of dollars through the international financial system via Iranian exchange houses and foreign front companies under their control as part of Iran’s “shadow banking” network. The regime leverages this network to evade sanctions and move money from its oil and petrochemical sales, which help the regime fund its nuclear and missile programs and support its terrorist proxies. Concurrently, Treasury’s Financial Crimes Enforcement Network (FinCEN) is issuing an updated Advisory to assist financial institutions in identifying, preventing, and reporting suspicious activity connected with Iranian illicit financial activity, including oil smuggling, shadow banking, and weapons procurement.

“Iran’s shadow banking system is a critical lifeline for the regime through which it accesses the proceeds from its oil sales, moves money, and funds its destabilizing activities,” said Secretary of the Treasury Scott Bessent. “Treasury will continue to leverage all available tools to target the critical nodes in this network and disrupt its operations, which enrich the regime’s elite and encourage corruption at the expense of the people of Iran.”

Today’s action is being taken pursuant to Executive Order (E.O.) 13902, which targets Iran’s financial and petroleum and petrochemical sectors, and E.O. 13846, and is the first round of sanctions targeting Iranian shadow banking infrastructure since the President issued National Security Presidential Memorandum 2, directing a campaign of maximum pressure on Iran.

SHADOW BANKING: THE REGIME’S CLANDESTINE AND CORRUPT SCHEME

Iran’s shadow banking networks, comprised of numerous financial facilitators like the Zarringhalam brothers, allows sanctioned Iranian persons and military organizations to access the international financial system and facilitate Iran’s international exports, the proceeds of which fund Iran’s military and its terrorist proxies. The system operates as a parallel banking system in which settlements are brokered through Iran-based exchange houses that use front companies outside of Iran, primarily located in Hong Kong and United Arab Emirates (UAE), to make or receive payments on behalf of sanctioned persons in Iran. To justify payments for sanctioned goods, shadow banking brokers may generate fictitious invoices or transaction details. Front companies are created in jurisdictions with lower levels of regulatory supervision so that they can avoid scrutiny of their business practices or ownership. The shadow banking system negatively impacts the Iranian people as well; Iranian whistleblowers have highlighted instances of Iranian government agents embezzling billions of dollars and other acts of corruption through this banking network.

THE ZARRINGHALAM Brothers

Through a network of front companies in the UAE and Hong Kong, the Zarringhalam brothers assisted sanctioned regime officials and affiliated businessmen in receiving payments from the sale of petroleum, petroleum products, and other commodities from foreign purchasers. The Zarringhalam network is used by Iran’s main oil and petrochemical exporters, as well as the Iranian military, to evade sanctions and send and receive funds related to oil and petrochemical sales.

Mansour Zarringhalam (Mansour) and Nasser Zarringhalam (Nasser) operate Iran-based exchange houses Mansour Zarrin Ghalam and Partners Company (also known as GCM Exchange), and Nasser Zarrin Ghalam and Partners Company (also known as Berelian Exchange), respectively, through which they oversee a sprawling network of front companies, largely operating out of the UAE and Hong Kong. These front companies operate accounts in multiple currencies at various banks to facilitate payments for blocked Iranian entities engaged in the sale of Iranian oil and petrochemicals, among other goods, including the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF).

For example, GCM Exchange has assisted the IRGC-QF in receiving funds from the U.S.-sanctioned Astan Quds Foundation via money transfers through China and has also assisted Astan Quds Foundation and the IRGC-QF in collecting approximately $100 million through currency exchanges. The Nasser-controlled Berelian Exchange has assisted the U.S.-designated National Iranian Oil Company (NIOC) in executing financial transactions for over a decade; Nasser worked with NIOC to finance the shipment of Iranian crude oil to the former regime of Bashar Al-Assad in Syria. Berelian Exchange has also facilitated transactions on behalf of Iran’s Ministry of Defense and Armed Forces Logistics (MODAFL).

Mansour and Nasser, through GCM Exchange and Berelian Exchange, have played a particularly significant role laundering money for Persian Gulf Petrochemical Industry Company (PGPIC), Iran’s largest petrochemical conglomerate, and its marketing arm Persian Gulf Petrochemical Industry Commercial Co. (PGPICC), both designated in 2019. According to some estimates, Mansour annually managed billions of dollars’ worth of currency transactions related to the sale of PGPIC petrochemical products, with the express consent of senior Iranian security officials.

Berelian Exchange has employees both in Iran and abroad, including Iran-based Fatemeh Sarlak Kuhi and China-based Yu Zhang, who coordinate Berelian Exchange’s transactions and assist in the daily affairs of the company.

A third brother, Fazlolah Zarringhalam,operates a third exchange known as Zarrin Ghalam and Partners Company (also known as Zarrin Ghalam Exchange) in Iran. Zarrin Ghalam Exchange has assisted the Central Bank of Iran in exchanging over a hundred million dollars’ worth of foreign currencies and has enabled the National Iranian Tanker Company (NITC) to pay non-Iranian companies employed by NITC. Zarrin Ghalam Exchange has, in coordination with the U.S.-designated Sadaf Exchange, transferred foreign currency on behalf of MODAFL, in addition to transferring funds related to Iranian petrochemical sales and procurement activities.

Mansour Zarringhalam, Nasser Zarringhalam, Fazlolah Zarringhalam, Mansour Zarrin Ghalam and Partners Company, Nasser Zarrin Ghalam and Partners Company, and Zarrin Ghalam and Partners Company are being designated pursuant to E.O. 13902 for operating in the financial sector of the Iranian economy. Fatemeh Sarlak Kuhi and Yu Zhang are being designated pursuant to E.O. 13902 for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Berelian Exchange.

HONG KONG FRONT COMPANIES

The Zarringhalam brothers operate a network of front companies in Hong Kong and the UAE to facilitate international transactions on behalf of Iranian entities. Illicit actors such as the Zarringhalam brothers frequently use Hong Kong or the UAE to establish their cover companies because they are easy to establish and subject to less scrutiny and oversight in these jurisdictions.

Hero Companion Limited, Plzcome Limited, and Kinlere Trading Limited have assisted NIOC in receiving millions of dollars in payments for petroleum product sales. In February 2025, Hero Companion Limited facilitated NIOC’s receipt of approximately $20 million in payments from petroleum products sold to U.S.-sanctioned Petroquimico FZE. Hero Companion Limited has also been used to obfuscate Iranian shipments of petroleum products to end users in China. In April 2024, Plzcome Limited assisted NIOC in receiving over $9 million dollars in payments for petroleum product sales. Kinlere Trading Limited supported NIOC in receiving over $18 million dollars in payments from the sale of petroleum products. Questano HK Limited and Chunling HK Limited have similarly been used by MODAFL to transfer foreign currency for its economic activities.

Kinlere Trading Limited and Yiminai Autoparts Trading Limited have been used by PGPICC to engage in international financial transactions and access foreign currency related to the sale of Iranian petrochemical products.

OFAC is also designating the following 11 Hong Kong-based front companies used by both Berelian Exchange and GCM Exchange to conduct money laundering activities. These Hong Kong-based companies have engaged in hundreds of millions of dollars’ worth of clandestine financial activity in multiple currencies, including dollars and euros.

- Bstshesh HK Limited

- Fitage Limited

- Gutown Trade Limited

- Konosag Trading Limited

- Lastsix Trading Limited

- Magical Eagle Limited

- Marlena Trading Limited

- Prettandy Trading Limited

- Profu Company Limited

- Saledige Trading Limited

- Xia Trading Limited

Bstshesh HK Limited, Chunling HK Limited, Fitage Limited, Gutown Trade Limited, Hero Companion Limited, Kinlere Trading Limited, Konosag Trading Limited, Lastsix Trading Limited, Magical Eagle Limited, Marlena Trading Limited, Plzcome Limited, Prettandy Trading Limited, Profu Company Limited, Questano HK Limited, Saledige Trading Limited, Xia Trading Limited, and Yiminai Autoparts Trading Limited are all being designated pursuant to E.O. 13902 for being owned or controlled by, or having acted or purported to act for or on behalf, directly or indirectly, Berelian Exchange.

UAE FRONT COMPANIES

OFAC is also designating five UAE-based front companies that are either owned by, or operate in support of, the Zarringhalam network. Wide Vision General Trading L.L.C and J.S Serenity FZE have been used by Mansour and GCM Exchange for coordinating shadow banking transactions. In 2023, J.S Serenity Trading FZE was used by Mansour to coordinate a brokerage agreement with U.S.-designated Sepehr Energy Jahan Nama Pars Company, a front company for Iran’s Armed Forces General Staff and its oil sales activities.

Moderate General Trading L.L.C, Ace Petrochem FZE, and Golden Pen General Trading L.L.C have each been used by Nasser and Berelian Exchange as front companies to help sanctioned Iranian entities engage in international financial transactions. For over a decade, Nasser has used Moderate General Trading L.L.C to conduct financial transactions worth millions of dollars on behalf of NIOC and NITC. In 2022, both Ace Petrochem FZE and Moderate General Trading L.L.C were listed in correspondence from Berelian Exchange confirming payments with NITC. Ace Petrochem FZE has also been used by PGPICC as a third-party account in payments to obscure the destination of funds and evade sanctions.

Wide Vision General Trading L.L.C is being designated pursuant to E.O. 13902 for being owned or controlled by, or having acted or purported to act for or on behalf of, directly or indirectly, Mansour Zarringhalam. J.S Serenity FZE is being designated pursuant to E.O. 13902 for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, GCM Exchange. Golden Pen General Trading L.L.C is being designated pursuant to E.O. 13902 for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Berelian Exchange and Nasser Zarringhalam. Moderate General Trading L.L.C and Ace Petrochem FZE are being designated pursuant to E.O. 13846 for , on or after November 5, 2018, having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, NITC, an Iranian person included on the SDN List.

THE ZARRINGHALAM FAMILY AND ITS ECONOMIC INTERESTS

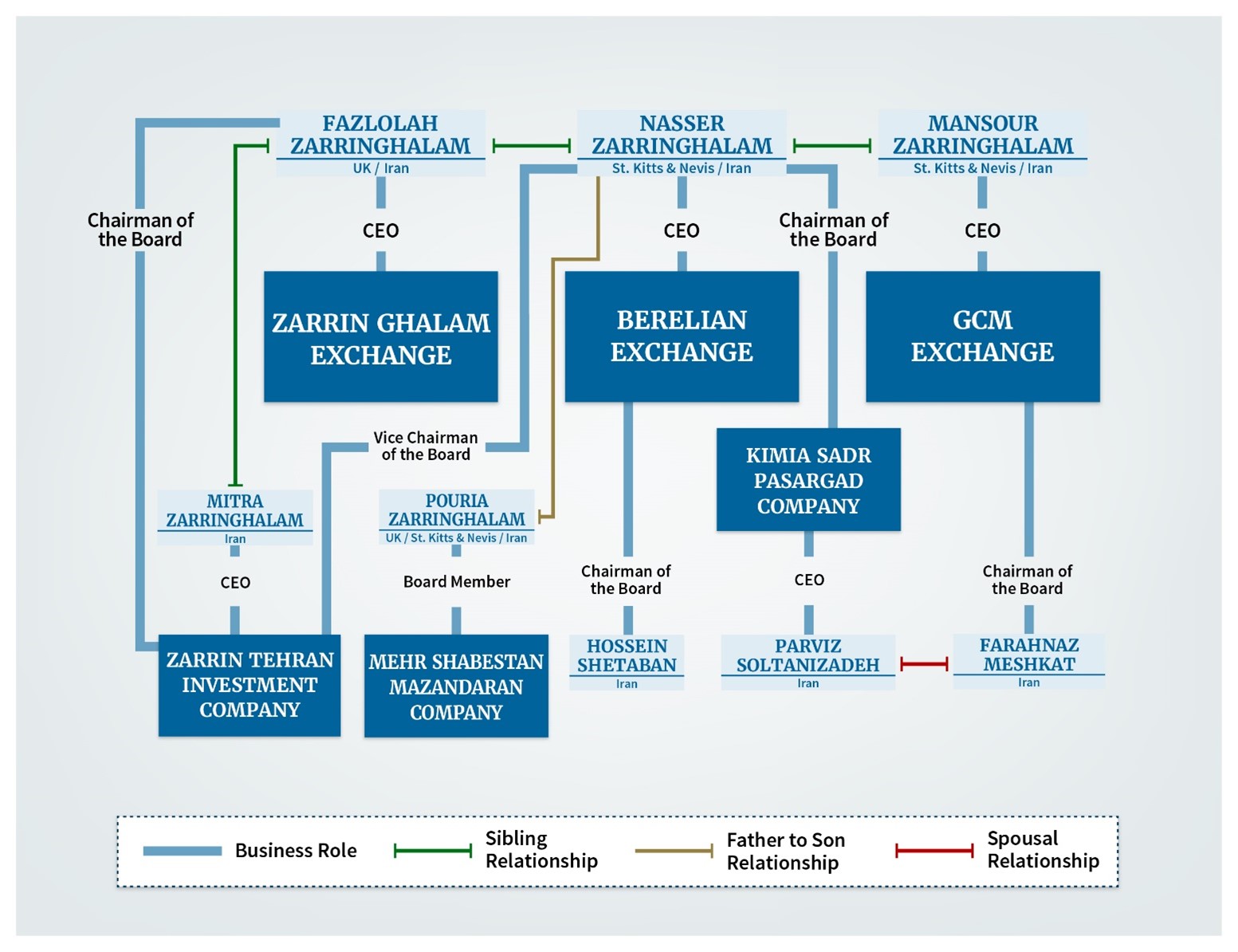

In addition to their significant currency exchange businesses, the Zarringhalam family controls a number of companies involved in various sectors of Iran’s economy. OFAC is designating Zarrin Tehran Investment Company, the Zarringhalam family’s investment company in Iran, as well as a company active in the oil, gas, and petrochemical fields tied to the Zarringhalams, Kimia Sadr Pasargad Company. OFAC is also designating a number of Zarringhalam family members and associates tied to the Zarringhalam exchanges and other Zarringhalam companies. Mitra Zarringhalam is the CEO of Zarrin Tehran Investment Company and sits on the board of directors with her brothers Fazlolah Zarringhalam and Nasser Zarringhalam. Parvis Soltanizadeh sits on the board of Kimia Sadr Pasargad Company along with Nasser Zarringhalam. Hossein Shetaban and Farahnaz Meshkat sit on the board of directors of Berelian Exchange and GCM Exchange, respectively. Pouria Zarringhalam is a member of the board of directors of an Iranian construction company along with his father, Nasser Zarringhalam.

Kimia Sadr Pasargad Company is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy. Parvis Soltanizadeh is being designated pursuant to E.O. 13902 for having acted or purported to act for or on behalf of, directly or indirectly, Kimia Sadr Pasargad Company. Hossein Shetaban and Farahnaz Meshkat are being designated pursuant to E.O. 13902 for operating in the financial sector of the Iranian economy. Pouria Zarringhalam is being designated pursuant to E.O. 13902 for operating in the construction sector of the Iranian economy. Zarrin Tehran Investment Company is being designated pursuant to E.O. 13902 for being owned or controlled by, or having acted or purported to act for or on behalf of, directly or indirectly, Fazlolah Zarringhalam. Mitra Zarringhalam is being designated pursuant to E.O. 13902 for having acted or purported to act for or on behalf of, directly or indirectly, Zarrin Tehran Investment Company.

SANCTIONS IMPLICATIONS

As a result of today’s action, all property and interests in property of the designated or blocked persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of blocked persons.

Violations of U.S. sanctions may result in the imposition of civil or criminal penalties on U.S. and foreign persons. OFAC may impose civil penalties for sanctions violations on a strict liability basis. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. economic sanctions. In addition, financial institutions and other persons may risk exposure to sanctions for engaging in certain transactions or activities with designated or otherwise blocked persons. The prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any designated or blocked person, or the receipt of any contribution or provision of funds, goods, or services from any such person.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, or to submit a request, please refer to OFAC’s guidance on Filing a Petition for Removal from an OFAC List.

Click here for more information on the persons designated today.

###