WASHINGTON — The U.S. Department of the Treasury is offering $96 billion of Treasury securities to refund approximately $57 billion of privately-held Treasury notes and bonds maturing on May 15, 2020. This issuance will raise new cash of approximately $39 billion. The securities are:

- A 3-year note in the amount of $42 billion, maturing May 15, 2023;

- A 10-year note in the amount of $32 billion, maturing May 15, 2030; and

- A 30-year bond in the amount of $22 billion, maturing May 15, 2050.

The 3-year note will be auctioned on a yield basis at 1:00 p.m. EDT on Monday, May 11, 2020. The 10-year note will be auctioned on a yield basis at 1:00 p.m. EDT on Tuesday, May 12, 2020. The 30-year bond will be auctioned on a yield basis at 1:00 p.m. EDT on Wednesday, May 13, 2020. All of these auctions will settle on Friday, May 15, 2020.

The balance of Treasury financing requirements over the quarter will be met with the weekly bill auctions, cash management bills (CMBs), and the monthly note, bond, Treasury Inflation-Protected Securities (TIPS) auctions, and 2-year Floating Rate Note (FRN) auctions.

Projected Financing Needs

Treasury’s borrowing needs have increased substantially as a result of the federal government’s response to the COVID-19 outbreak. Since the end of March, Treasury has raised an unprecedented $1.464 trillion on net and the Treasury cash balance has reached historically high levels. Over the next quarter, Treasury’s cash balance will likely remain elevated as Treasury seeks to maintain prudent liquidity in light of the size and relative uncertainty of COVID-19-related outflows.

While the initial increases in financing related to the COVID-19 outbreak response were focused on Treasury bills, Treasury expects to begin to shift financing from bills to longer-dated tenors over the coming quarters. In light of the substantial increase in borrowing needs, Treasury plans to increase its long-term issuance as a prudent means of managing its maturity profile and limiting potential future issuance volatility.

Financing Needs for the Upcoming Quarter

Based on current fiscal forecasts, Treasury intends to increase auction sizes across all nominal coupon tenors over the May-to-July quarter. The increase in coupon issuance will be larger in longer tenors (7-year, 10-year, 20-year, and 30-year). Treasury also intends to modestly increase auction sizes for floating-rate notes (FRNs). Meanwhile, auction sizes for TIPS will remain unchanged.

Treasury plans to address any seasonal or unexpected variations in borrowing needs over the next quarter through changes in regular bill auction sizes and/or CMBs.

Nominal Coupon and FRN Financing

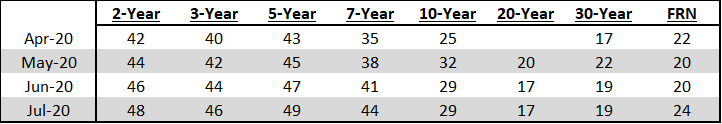

Over the next three months, Treasury anticipates increasing the sizes of the 2-, 3-, and 5-year note auctions by $2 billion per month. As a result, the size of 2-, 3-, and 5-year note auctions will each increase by $6 billion by the end of July. Treasury also anticipates increases in the auction sizes of 7-year notes of $3 billion per month over the next 3 months. The size of the 7-year note auction will increase by $9 billion by the end of July.

Treasury is also announcing increases of $5 billion to both the new and reopened 10-year note auction sizes, and increases of $3 billion to both the new and reopened 30-year bond auction sizes starting in May.

In addition, following the $2 billion increase in the April new-issue FRN auction size, the May and June FRN reopening sizes will be increased by $2 billion (resulting in a $20 billion auction size for each). Treasury anticipates that it will increase the size of the next new-issue 2-year FRN auction in July by $2 billion to $24 billion.

Introduction of a 20-Year Nominal Coupon Bond

Treasury anticipates that the initial offering size of the 20-year bond will be $20 billion and that the auction will take place on Wednesday, May 20, 2020, at 1:00 p.m. EDT. As outlined in the previous refunding statement, the security will have a dated date of May 15, 2020, and the maturity date will be May 15, 2040. The security will settle on Monday, June 1, 2020, because May 31, 2020, is a Sunday.

Treasury anticipates reopening the 20-year bond in both June and July in amounts of $17 billion for each auction. This security will raise an additional $54 billion in new cash over the quarter. Additional details for the auction of the 20-year bond offering will be announced on Thursday, May 14, 2020 at 11:00 a.m. EDT.

The anticipated changes in auction sizes are presented in the table below in $ billion:

The changes in coupon and FRN auction sizes announced today will result in an additional $154 billion of issuance to private investors during the May-July quarter compared to the February-April quarter.

Bill Financing

Over the upcoming quarter, Treasury will continue to supplement its regular benchmark bill financing with a regular cadence of CMBs. Treasury anticipates that weekly issuance of 6- and 17-week CMBs for Thursday settlement and maturity as well as 15- and 22-week CMBs for Tuesday settlement and maturity will continue at least through the end of July. It is anticipated that these CMBs will be announced as part of the regular Tuesday and Thursday bill announcement cycle.

TIPS Financing

Over the next refunding quarter, Treasury expects to maintain TIPS issuance sizes at $12 billion for the May 10-year TIPS reopening, $15 billion for the June 5-year TIPS reopening, and $14 billion for the July 10-year TIPS. Treasury will continue to closely monitor TIPS market conditions and assess supply and demand dynamics when considering how best to meet future financing needs.

As always, Treasury will continue to evaluate the fiscal outlook and assess the need for additional increases to auction sizes at subsequent quarterly refundings.

Treasury Plans to Issue a Request for Information (RFI) on SOFR-Indexed FRNs

Treasury continues to explore the possibility of issuing a floating rate note indexed to the Secured Overnight Financing Rate (SOFR). As noted in the February 2020 quarterly refunding announcement, Treasury plans to issue an RFI to further our understanding of potential demand for such a security and how it might fit into Treasury’s goal of financing the government at the least cost over time. Treasury expects to release the RFI in May 2020 and encourages market participants and the public to respond.

Small-Value Contingency Auction Operation Test

Treasury believes that it is prudent to regularly test its contingency auction infrastructure. Treasury’s contingency auction system has been used routinely over the last several years to conduct both mock auctions and live small-value test auctions. Sometime over the next three months, Treasury intends to conduct a small-value test auction using its contingency auction system. Details about this test will be announced at a later date.

This small-value test auction should not be viewed by market participants as a precursor or signal of any pending policy changes regarding Treasury’s existing auction processes.

Please send comments or suggestions on these subjects or others related to debt management to debt.management@treasury.gov.

The next quarterly refunding announcement will take place on Wednesday, August 5, 2020.

###