WASHINGTON -- The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing[1] for the July – September 2018 and October – December 2018 quarters:

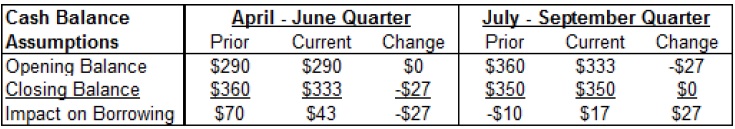

- During the July – September 2018 quarter, Treasury expects to borrow $329 billion in privately-held net marketable debt, assuming an end-of-September cash balance of $350 billion. The borrowing estimate is $56 billion larger than announced in April 2018. The increase in borrowing is driven by both changes in the cash balance and lower net cash flows.[2]

- During the October – December 2018 quarter, Treasury expects to borrow $440 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $390 billion.2

During the April – June 2018 quarter, Treasury borrowed $72 billion in privately-held net marketable debt and ended the quarter with a cash balance of $333 billion. In April 2018, Treasury estimated privately-held net marketable borrowing of $75 billion and assumed an end-of-June cash balance of $360 billion. The decrease in the cash balance resulted primarily from lower net cash flows.

Additional financing details relating to Treasury’s Quarterly Refunding will be released at 8:30 a.m. on Wednesday, August 1, 2018.

###

[1] Privately-held net marketable borrowing excludes rollovers (auction “add-ons”) of Treasury securities held in the Federal

Reserve’s System Open Market Account (SOMA), but includes financing required due to SOMA redemptions.

[2]