by Luke Bassett, Director of Policy and Program Impact, IRA Implementation

There has long been a need to reinvest in coal country and communities that have been at the forefront of manufacturing and fossil fuel production in America. Now, President Biden’s Inflation Reduction Act (IRA) is fueling demand for investment in clean energy manufacturing facilities in those communities. Initial allocations for the § 48C Qualifying Advanced Energy Project Credit point to this strong and growing appetite: the Biden-Harris administration announced $4 billion in tax credits for over 100 projects across 35 states to accelerate domestic clean energy manufacturing and reduce greenhouse gas emissions at industrial facilities, with $1.5 billion supporting projects in historic energy communities. Initial interest in concept papers submitted earlier in this first round indicated approximately 10 times more funding requested than the anticipated allocation. On May 22, 2024, the Department of Energy will open the 48C portal for Round 2 concept paper submissions, with the thirty-day concept paper submission period ending on June 21, 2024 at 5pm eastern time.

As a crucial component of President Biden’s economic engine, the § 48C credit is incentivizing and anchoring investments in clean energy manufacturing facilities – and the good-paying jobs that go along with them – to strengthen the economies of coal communities and other areas that have experienced underinvestment in past decades. This is a key part of the Inflation Reduction Act’s energy security and manufacturing agenda and is a proven way to help bring success to communities that need reinvestment. Through these efforts, the Biden-Harris Administration and the private sector are writing a new chapter in the history of investing in the nation’s clean energy manufacturing.

A History of Investing in American Clean Energy Manufacturing

After decades of underinvestment and jobs being shipped overseas, American manufacturing faced tremendous headwinds even before the 2008 Great Recession.

Responding to the 2008 crisis, President Barack Obama signed the American Recovery and Reinvestment Act of 2009 (the Recovery Act) into law. As part of an overall $90 billion investment in clean energy, the Recovery Act included the Advanced Energy Project Credit (§ 48C), a first-of-its-kind 30% investment tax credit, which allocated $2.3 billion to provide incentives to build, re-equip, or expand the facilities necessary to produce a new generation of clean energy technologies. When signed into law, the program criteria prioritized investments that would also enable domestic job creation, avoid or reduce pollution, and harness technological innovation.

As established in the Recovery Act, DOE reviews § 48C applications and makes recommendations to inform the IRS’s determinations of which applicants receive an allocation. Over the course of the initial § 48C program, DOE received applications requesting a total of more than $8 billion, or a nearly 3-to-1 ratio to available funding. The awarded funding catalyzed up to $5.4 billion in private investment across facilities designed to manufacture technologies from solar panels to carbon capture equipment to high-efficiency heat pumps and light bulbs.

Through the allocation of that initial $2.3 billion in the 2010s, the § 48C credit provided incentives to at least 38 states across clean energy product manufacturing, including: [1]

- Batteries – $29.4 million;

- Biomass – $29.3 million;

- Building technologies – $146.6 million;

- Carbon capture and sequestration technologies – $4.8 million;

- Fuel cells – $5.5 million;

- Geothermal – $8.9 million;

- Industrial emissions technologies – $166.5 million;

- Nuclear – $73.8 million;

- Smart grid – $35.7 million;

- Solar (photovoltaic and concentrated) – $840.9 million;

- Vehicles – $46.8 million; and

- Wind – $258.5 million.

Through these investments, the Recovery Act’s § 48C credit established a model for other provisions in the Inflation Reduction Act and Infrastructure Investment and Jobs Act by providing incentives to clean energy manufacturing facilities as a method of economic relief for domestic supply chains.

Updating the § 48C Credit for a New Era

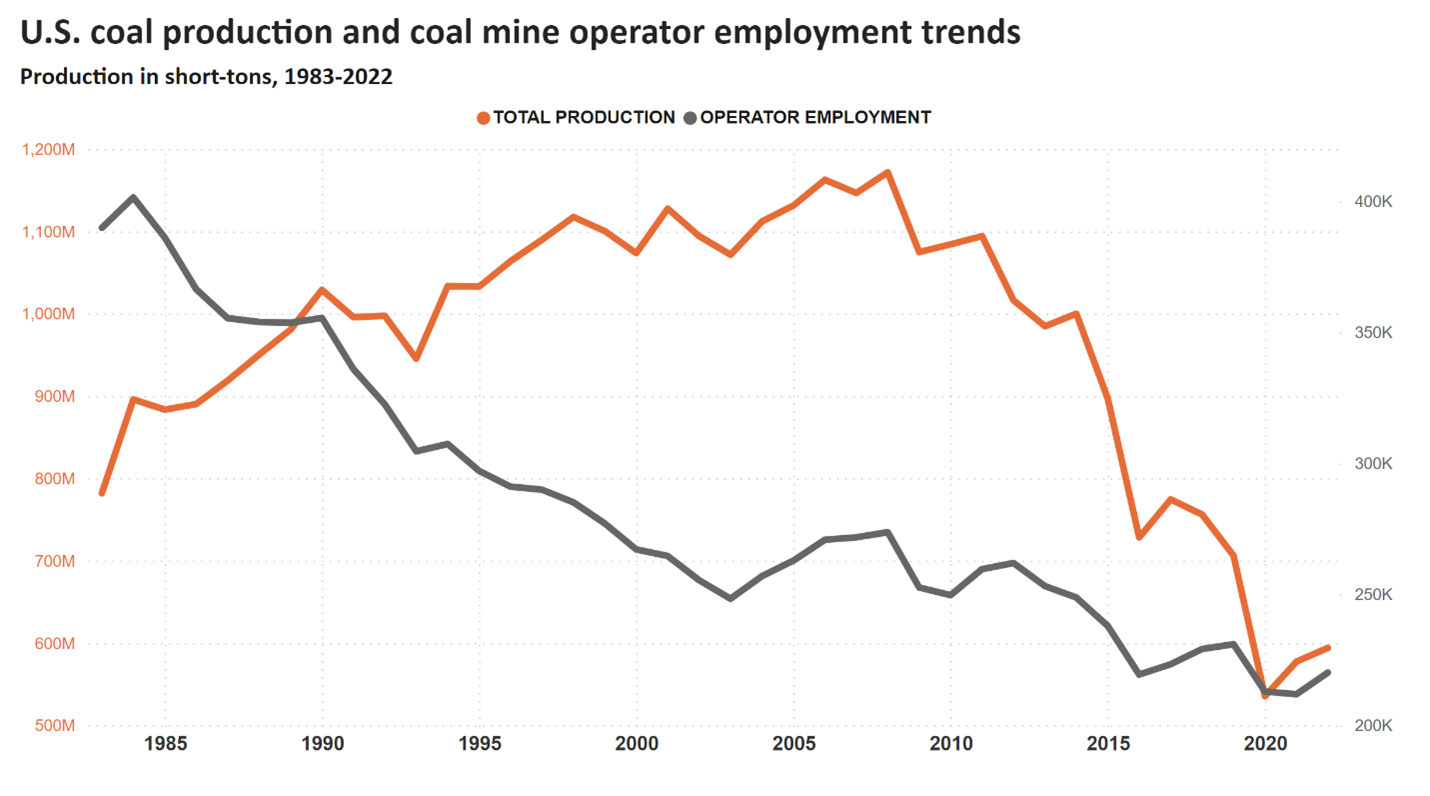

Over a longer period of time, the coal industry--and the workers and communities centered around it--had undergone a period of economic decline. Although total mine production had outpaced mine employment rates due to mechanization since the 1980s, recent trends pointed both to continuing decline in employment as well as declining production rates overall.[2]

Lower exports of metallurgical coal combined with a competitive disadvantage between coal sources in the Appalachian basin and the Powder River basin had further depressed the industry central to coal communities in the eastern United States. And incentives in clean energy technologies – and their manufacturing supply chains – were not targeted at communities or workers losing jobs, instead following wind- or solar-rich areas elsewhere.

In 2021, as the United States faced the combined challenges of post-pandemic recovery, inflation, and an energy security crisis abroad, President Biden and the Congress turned again to the § 48C Credit as a mechanism to focus investment on clean energy manufacturing and the facilities that shore up – and onshore –supply chains and good-paying jobs. Beginning to address these intertwined economic and energy issues, Senator Joe Manchin III, Senator Debbie Stabenow, and Senator Steve Daines cosponsored a bipartisan update to § 48C – the American Jobs in Energy Manufacturing Act of 2021. This bill reflected updates in technological trends, new demands in manufacturing, competitive investments in critical minerals processing, and the challenge posed by industrial emissions of greenhouse gases in incumbent facilities, from cement-making to chemical production and more. It subsequently became part of the tax provisions in the Inflation Reduction Act, as well as influencing other aspects of economic reinvestment provisions across President Biden’s agenda.

Seeking ways to invest directly in workers and communities where jobs had been lost over time, Senator Manchin led the legislative efforts to guarantee a sizable portion of the § 48C funding focus on communities in census tracts where coal mines have closed or coal-fired power plants have retired. Through President Biden’s leadership, the § 48C credit is a pivotal program in the Inflation Reduction Act and its reinvestment in manufacturing, the creation of good-paying jobs – including through new prevailing wage and apprenticeship requirements, and the high-skilled workers who live in coal communities.

With the additional funding from the Inflation Reduction Act, Treasury, the IRS, and the Department of Energy (DOE) reestablished the § 48C program and launched the first allocation round to spur project development and initial investment.

Timeline and Key Statistics of § 48C Qualifying Advanced Energy Project Program

February 17, 2009: Enactment of the American Recovery and Reinvestment Act of 2009.

January 8, 2010: Certification announcement for Recovery Act era program.

March 4, 2013: Reallocation announcement for Recovery Act era program.

Nearly one decade later…

August 16, 2022: Enactment of the Inflation Reduction Act of 2022.

February 13, 2023: Publication of initial guidance for the § 48C program and announcement of an anticipated first round allocation of $4 billion, with up to $1.6 billion anticipated for coal community census tracts.

May 31, 2023: Release of additional guidance describing submission requirements and other details relevant to the first allocation.

August 3, 2023: Deadline for first allocation project proposals (or concept papers). The § 48C program received concept papers seeking a total of nearly $42 billion in funding for the $4 billion available in its initial allocation round, or approximately 10 times more funding requested than the anticipated allocation. The received concept papers sought approximately $11 billion in funding for the designated coal communities set aside, or approximately 10 times greater than the $1.6 billion anticipated allocation. DOE provided applicants feedback related to their concept papers before applicants decide whether to submit a full application. Altogether, the submitted concept papers included requests for:

- Approximately $27 billion in credits for Clean Energy Manufacturing and Recycling projects, that would leverage private investment for a total proposed project investment of approximately $92 billion.

- Approximately $8 billion in credits for Greenhouse Gas Emission Reduction projects, that would leverage private investment for a total proposed project investment of approximately $28 billion.

- Approximately $6 billion in credits for Critical Materials projects, that would leverage private investment for a total proposed project investment of approximately $21 billion.

December 26, 2023: Deadline for applications for first allocation. DOE received approximately 250 full applications from projects requesting a total of approximately $13.5 billion in tax credits.

March 29, 2024: Treasury, IRS, and DOE announced $4 billion in Round 1 tax credit allocations to over 100 projects across 35 states, including approximately $1.5 billion supporting projects in historic energy communities – communities with closed coal mines or coal plants under § 48C guidance Of the $4 billion allocated in Round 1:

- Approximately $2.7 billion in tax credits for Clean Energy Manufacturing and Recycling projects.

- Approximately $500 million in tax credits for Greenhouse Gas Emission Reduction projects.

- Approximately $800 million in tax credits Critical Materials projects.

April 29, 2024: Release of guidance for round 2 tax credit allocations.

May 22, 2024: Opening of the 48C portal for round 2 concept paper submissions.

The § 48C credit program draws on a proven method of economic investment and sharpens that approach so that incentives draw private investment to unite the longstanding skills found in coal communities with the economic and energy security needs facing the nation today.

Additional Information on § 48C Qualifying Advanced Energy Project Credit

Treasury and the IRS issued guidance on Round 2 of the § 48C tax credit on April 29, 2024 and have provided guidance previously on the §48C credit program here.

You can find more information about the IRA’s tax incentives here and broader manufacturing-related incentives here.

[1] This analysis includes data reported and categorized by DOE but excludes the additional, uncategorized funding amounts allocated (and reported) under the §48C credit program at the time.

[2] Sources: U.S. Energy Information Administration, Monthly Energy Review, Table 6.1, November 2023. U.S. Mine Safety and Health Administration, Mine Data Retrieval System, December 12, 2023.