Since 2022 and due to increased funding provided by President Biden’s Inflation Reduction Act, the Internal Revenue Service (IRS) has made significant strides in enhancing customer service and modernizing its operations. These enhancements have made it easier for taxpayers to reach the IRS any way they choose, whether that’s in-person, on the phone, in writing, or online.

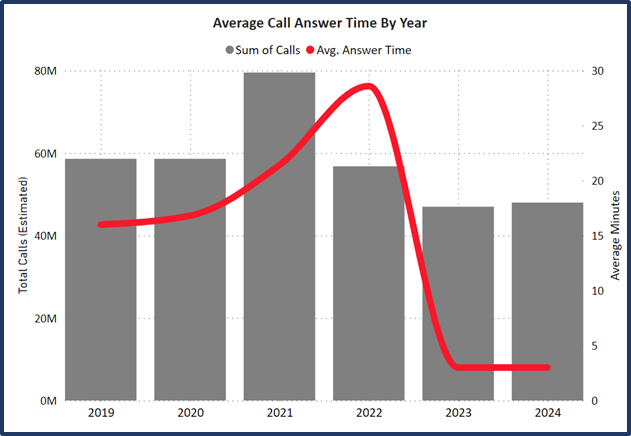

Last year, during Filing Season 2023, the IRS was able to deliver historic improvements for Americans filing their tax returns, including cutting phone wait times from 28 minutes down to 3 minutes, assisting over 100,000 more taxpayers in person, and providing a suite of new digital tools.

This year, in Filing Season 2024, these improvements have continued, and the IRS has met or exceeded the Secretary’s goals for this filing season, and many of the customer service goals outlined in its Strategic Operating Plan.

Phone Services

The IRS answered more taxpayer calls on its main live assistor lines this year, a 17.3% increase from 2023. IRS assistors handled 9 million calls, up from 7.7 million the year before. IRS automated lines handled another approximately 8.9 million calls, 500,000 more than the previous year. Additionally, taxpayers received faster response times. Taxpayers waited, on average, just over three minutes for help on the IRS main phone lines. This wait time is consistent with three minutes delivered during in filing season 2023 and less than the average of 28 minutes delivered during filing season 2022.

Source: IRS Data Book 2019-2023. IRS estimates for 2024

Funding provided by the Inflation Reduction Act made possible over 5,000 new hires, which helped drive down call wait time. The IRS also expanded the Customer Callback capabilities that allow eligible taxpayers to hang up if the projected wait time was longer than 15 minutes and receive a call-back after from an available assistor. This is estimated to have collectively saved taxpayers over 1.5 million hours of hold time.

Digital Services

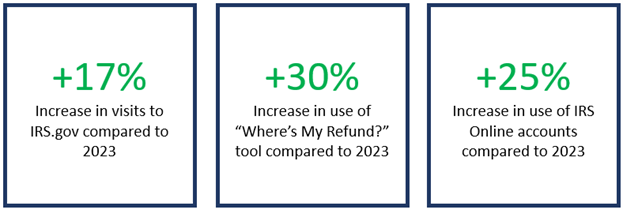

Filing Season 2024 is also seeing many of the IRS’s new investments in online tools, made possible by IRA resources, lead to better service in the form of increased web traffic and usage by taxpayers. Across all web services, the IRS has seen a 41% increase in usage rate so far for Filing Season 2024.

Examples of these usage increases include:

- 17% increase in visits to IRS.gov where taxpayers can find helpful information, tax forms, and much more.

- 30%increase in use of “Where’s My Refund?” tool for taxpayers to check their refund status.

- 25%increase in the use of IRS Online account where individual taxpayers can view specific details about their federal tax account.

The increases in usage by taxpayers speaks to the attention and resources the IRS has devoted to making the online experience more accessible, customer-friendly, and reliable.

For example, updates made over the past year to the “Where's My Refund?” tool have allowed taxpayers to see more detailed refund status messages in plain language. In the past, taxpayers may have encountered a generic message stating that their returns were still being processed and to check back later. With the new and improved “Where's My Refund?” tool, taxpayers are seeing clearer and more detailed updates, including whether the IRS needs them to respond to a letter requesting additional information.

The recent funding through the Inflation Reduction Act has made these IRS digital service updates available and improved.

In-Person Services

In addition to providing excellent customer service by phone and online, the IRS also committed to ensuring that taxpayers who need in-person assistance could do so during Filing Season 2024.

This included opening more Taxpayer Assistance Centers (TACs), Volunteer Income Tax Assistance (VITA) sites, and Tax Counseling for the Elderly (TCE) sites. It also meant keeping them open for longer and expanding the range of services offered.

Taxpayer Assistance Centers (TAC)

Taxpayers can visit a TAC to ask questions about a tax bill or an IRS audit or to get help resolving a tax problem. The Inflation Reduction Act funding has enabled the IRS to open or reopen 54 TACs, bringing the total number of TACs across the country to over 360. This includes hiring more than 800 new employees to staff these centers.

In addition to expanding sites and staff, the IRS extended its hours of operation and opened on Saturdays at many TACs across the country during Filing Season 2024.

In approximately 242 TAC locations extended hours were provided during Filing Season 2024, with nearly 13,000 extra service hours provided to taxpayers.

These enhancements together resulted in 784,000 face-to-face contacts with an IRS employee during Filing Season 2024. That’s a year-on-year increase of 37.1%, and IRS served 22,361 of those taxpayers during extended hours.

Volunteer Prepared Returns

The IRS also offers free tax return preparation to eligible taxpayers through the Volunteer Income Tax Assistance program and the Tax Counseling for the Elderly program.

VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $64,000 or less.

- Persons with disabilities.

- Taxpayers who speak limited English.

Similarly, the TCE program offers free tax help for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are operated by IRS partners and staffed by over 72,000 volunteers at over 9,000 different locations. Throughout Filing Season 2024, these programs and their volunteers helped to prepare over 2.7 million tax returns, up 300,000 from last year.

Additional Resources

Visit the resources below to learn more about how the IRS is improving service to taxpayers.

- IRS – Find the status of your refund with the Where’s My Refund? tool.

- IRS – Find your local Taxpayer Assistance Center

- IRS – Set up an individual online account with the IRS

- IRS – Find free tax preparation help locations