WASHINGTON -- The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing[1] for the April – June 2023 and July – September 2023 quarters.

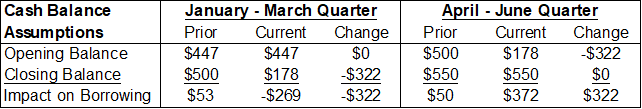

- During the April – June 2023 quarter, Treasury expects to borrow $726 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $550 billion.[2] The borrowing estimate is $449 billion higher than announced in January 2023, primarily due to the lower beginning-of-quarter cash balance ($322 billion), and projections of lower receipts and higher outlays ($117 billion).

- During the July – September 2023 quarter, Treasury expects to borrow $733 billion in privately-held net marketable debt, assuming an end-of-September cash balance of $600 billion.2

During the January – March 2023 quarter, Treasury borrowed $657 billion in privately-held net marketable debt and ended the quarter with a cash balance of $178 billion. In January 2023, Treasury estimated borrowing of $932 billion and assumed an end-of-March cash balance of $500 billion. The $275 billion difference in privately-held net market borrowing resulted primarily from the lower end-of-quarter cash balance, somewhat offset by lower net fiscal flows.[3]

Additional financing details relating to Treasury’s Quarterly Refunding will be released at 8:30 a.m. on Wednesday, May 3, 2023.

###

[1] Privately-held net marketable borrowing excludes rollovers (auction “add-ons”) of Treasury securities held in the Federal Reserve System Open Market Account (SOMA) but includes financing required due to SOMA redemptions. Secondary market purchases of Treasury securities by SOMA do not directly change net privately-held marketable borrowing but, all else equal, when the securities mature and assuming the Federal Reserve does not redeem any maturing securities, would increase the amount of cash raised for a given privately-held auction size by increasing the SOMA “add-on” amount.

[2] The end-of-June and end-of-September cash balances assume enactment of a debt limit suspension or increase. Treasury’s cash balance may be lower than assumed depending on several factors, including constraints related to the debt limit. If Treasury’s cash balance for the end of either quarter is lower than assumed, and assuming no changes in the forecast of fiscal activity, Treasury would expect that borrowing would be lower by the corresponding amount(s).