Scams Targeting U.S. Victims Produce Significant Revenue for CJNG

WASHINGTON—Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned four Mexican individuals and 13 Mexican companies linked to timeshare fraud led by the Cartel de Jalisco Nueva Generacion (CJNG). These individuals and companies are based in or near Puerto Vallarta, a popular tourist destination that also serves as a strategic stronghold for CJNG. A brutally violent cartel, CJNG is a U.S.-designated Foreign Terrorist Organization (FTO) that is increasingly supplementing its drug trafficking proceeds with alternative revenue streams such as timeshare fraud and fuel theft.

“We are coming for terrorist drug cartels like Cartel de Jalisco Nueva Generacion that are flooding our country with fentanyl,” said Secretary of the Treasury Scott Bessent. “These cartels continue to create new ways to generate revenue to fuel their terrorist operations. At President Trump’s direction, we will continue our effort to completely eradicate the cartels’ ability to generate revenue, including their efforts to prey on elderly Americans through timeshare fraud.”

Treasury has taken a series of actions targeting the diverse revenue streams benefitting the cartels, including fuel theft, human smuggling, extortion, and fraud. As Treasury and its partners seek to disrupt the cartels’ revenue streams, it is important to remind current owners of timeshares in Mexico: If an unsolicited purchase or rental offer seems too good to be true, it probably is. Those considering the purchase of a timeshare in Mexico should conduct appropriate due diligence.

Today’s action was taken pursuant to Executive Order (E.O.) 14059, which targets the proliferation of illicit drugs and their means of production, and pursuant to E.O. 13224, as amended, which targets terrorists and their supporters. Today’s action was also taken in coordination with the Federal Bureau of Investigation (FBI), the Drug Enforcement Administration (DEA), and the Government of Mexico’s financial intelligence unit, the Unidad de Inteligencia Financiera (UIF).

CJNG: VIOLENCE IN PURSUIT OF PROFIT

CJNG is considered one of the most powerful cartels in the world. It has conducted intimidating acts of violence, including attacks on the Mexican military and police with military-grade weaponry, the use of drones to drop explosives on Mexican law enforcement, and assassinations and attempted assassinations of Mexican officials. CJNG has also executed its own recruits who defy orders. All of this is perpetrated in furtherance of CJNG’s relentless pursuit of illicit proceeds. In addition to drug trafficking, the group’s core source of revenue, CJNG is also generating alternative revenue streams through fuel theft, extortion, and timeshare fraud, among other activities.

On April 8, 2015, OFAC designated CJNG pursuant to the Foreign Narcotics Kingpin Designation Act (Kingpin Act) for playing a significant role in international narcotics trafficking. On December 15, 2021, OFAC also designated CJNG pursuant to E.O. 14059. On February 20, 2025, the U.S. Department of State designated CJNG as an FTO and a Specially Designated Global Terrorist (SDGT).

PARADISE LOST: TIMESHARE FRAUD IN MEXICO

Mexico-based cartels have been targeting U.S. owners of timeshares through call centers in Mexico staffed by telemarketers fluent in English. Beginning in about 2012, CJNG took control of timeshare fraud schemes in Puerto Vallarta, Jalisco, Mexico, and the surrounding area. These complex scams often target older Americans who can lose their life savings. The lifecycle of these scams can last years, resulting in financial and emotional devastation of the victims while enriching cartels like CJNG.

The cartels generally obtain information about U.S. owners of timeshares in Mexico from complicit insiders at timeshare resorts. After obtaining information on timeshare owners, the cartels, through their call centers, contact victims by phone or email and claim to be U.S.-based third-party timeshare brokers, attorneys, or sales representatives in the timeshare, travel, real estate, or financial services industries. The fraud may include timeshare exit scams (a.k.a. timeshare resale scams), timeshare re-rent scams, and timeshare investment scams. The common theme is that victims are asked to pay advance “fees” and “taxes” before receiving money supposedly owed to them. This money never comes, and the victims are continuously told to pay additional “fees” and “taxes” to finalize the transactions. Victims are typically told to send these “fees” and “taxes” via international wire transfers to accounts held at Mexican banks and brokerage houses. After these initial scams, re-victimization scams can occur. The scammers may impersonate law firms, claiming that they can initiate proceedings on behalf of the victims to recover lost funds for an upfront fee. In other instances, scammers impersonate government officials, including OFAC, claiming that victims have engaged in suspicious transactions and demanding “fines” to release their funds or face the risk of imprisonment.

On July 16, 2024, Treasury’s Financial Crimes Enforcement Network (FinCEN), OFAC, and the FBI issued a joint Notice on timeshare fraud associated with Mexico-based transnational criminal organizations (TCOs), including in Spanish, to provide financial institutions with an overview of these schemes, associated financial typologies, and red flag indicators. In the six-month period following this Notice, FinCEN received over 250 Suspicious Activity Reports, and filers reported approximately 1,300 transactions totaling $23.1 million, sent primarily from U.S.-based individuals to counterparties in Mexico. Based on FinCEN’s analysis, U.S. fraud victims sent an average of $28,912 and a median amount of $10,000 per transaction to the suspected scammers potentially working for Mexico-based TCOs.

According to the FBI, approximately 6,000 U.S. victims reported losing nearly $300 million between 2019 and 2023 to timeshare fraud schemes in Mexico. In 2024 alone, FBI’s Internet Crime Complaint Center (IC3) received nearly 900 complaints concerning timeshare fraud schemes in Mexico with reported losses of over $50 million. However, these figures likely underestimate total losses, as the FBI believes the vast majority of victims do not report the scam due to embarrassment, among other reasons. On its website, the FBI has included a timeshare fraud resource page, and FBI’s New York Field Office has posted a public service announcement video featuring a victim of timeshare fraud. Victims of timeshare fraud are encouraged to file a complaint with the FBI’s IC3 by visiting https://www.ic3.gov. For elder victims, financial institutions may also refer their customers to the Department of Justice’s National Elder Fraud Hotline at 833-FRAUD-11 (or 833-372-8311).

TARGETING TIMESHARE FRAUD

Today’s action marks the fifth time OFAC has sanctioned those linked, directly or indirectly, to CJNG’s timeshare fraud activities, resulting in the designation of over 70 individuals and entities to date. The previous actions occurred on March 2, 2023, April 27, 2023, November 30, 2023, and July 16, 2024.

The three senior CJNG members most involved in timeshare fraud are Julio Cesar Montero Pinzon (Montero), Carlos Andres Rivera Varela (Rivera), and Francisco Javier Gudino Haro (Gudino). These three individuals have also been part of a CJNG enforcement group based in Puerto Vallarta that orchestrates assassinations of rivals and politicians using high-powered weaponry.

On June 2, 2022, OFAC designated Montero pursuant to E.O. 14059. Today, Montero is being designated pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

On April 6, 2021, OFAC designated Rivera and Gudino pursuant to the Kingpin Act. Today, Rivera and Gudino are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

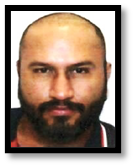

The other individual sanctioned today is Puerto Vallarta native Michael Ibarra Diaz Jr. (Ibarra). An ostensibly legitimate businessman involved in the tourism industry, Ibarra is engaged in timeshare fraud on behalf of CJNG. For over 20 years, Ibarra has been involved in the sale and management of timeshares in the Puerto Vallarta area, including just north in the state of Nayarit. Ibarra was trained as an accountant, which is consistent with CJNG’s use of professionals to conduct this complicated and highly lucrative scheme. Ibarra is being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

Also sanctioned today is Ibarra’s corporate network, which is composed of 13 companies. Five of the companies—Akali Realtors, Centro Mediador De La Costa, S.A. de C.V., Corporativo Integral De La Costa, S.A. de C.V., Corporativo Costa Norte, S.A. de C.V., and Sunmex Travel, S. de R.L. De C.V.—explicitly acknowledge their involvement in the timeshare industry. Another company involved in timeshare-related transactions—TTR Go, S.A. de C.V.—claims only to be a travel agency.

Also sanctioned today is Ibarra’s corporate network, which is composed of 13 companies. Five of the companies—Akali Realtors, Centro Mediador De La Costa, S.A. de C.V., Corporativo Integral De La Costa, S.A. de C.V., Corporativo Costa Norte, S.A. de C.V., and Sunmex Travel, S. de R.L. De C.V.—explicitly acknowledge their involvement in the timeshare industry. Another company involved in timeshare-related transactions—TTR Go, S.A. de C.V.—claims only to be a travel agency.  Three additional companies are purportedly engaged in real estate activities: Inmobiliaria Integral Del Puerto, S.A. de C.V., KVY Bucerias, S.A. de C.V., and Servicios Inmobiliarios Ibadi, S.A. de C.V. This diverse corporate network also includes tour operators (Fishing Are Us, S. De R.L. de C.V.; Santamaria Cruise, S. de R.L. de C.V.), an automotive service company (Laminado Profesional Automotriz Elte, S.A. de C.V.), and an accounting firm (Consultorias Profesionales Almida, S.A. de C.V.). These 13 companies are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Ibarra.

Three additional companies are purportedly engaged in real estate activities: Inmobiliaria Integral Del Puerto, S.A. de C.V., KVY Bucerias, S.A. de C.V., and Servicios Inmobiliarios Ibadi, S.A. de C.V. This diverse corporate network also includes tour operators (Fishing Are Us, S. De R.L. de C.V.; Santamaria Cruise, S. de R.L. de C.V.), an automotive service company (Laminado Profesional Automotriz Elte, S.A. de C.V.), and an accounting firm (Consultorias Profesionales Almida, S.A. de C.V.). These 13 companies are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Ibarra.

SANCTIONS IMPLICATIONS

As a result of today’s action, all property and interests in property of the designated or blocked persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of blocked persons.

Violations of U.S. sanctions may result in the imposition of civil or criminal penalties on U.S. and foreign persons. OFAC may impose civil penalties for sanctions violations on a strict liability basis. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. economic sanctions. In addition, financial institutions and other persons may risk exposure to sanctions for engaging in certain transactions or activities involving designated or otherwise blocked persons. The prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any designated or blocked person, or the receipt of any contribution or provision of funds, goods, or services from any such person.

Furthermore, engaging in certain transactions involving the persons designated today may risk the imposition of secondary sanctions on participating foreign financial institutions. OFAC can prohibit or impose strict conditions on opening or maintaining, in the United States, a correspondent account or a payable-through account of a foreign financial institution that knowingly conducts or facilitates any significant transaction on behalf of a person who is designated pursuant to the relevant authority.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, or to submit a request, please refer to OFAC’s guidance on Filing a Petition for Removal from an OFAC List.

Click here for more information on the persons designated today.

###