Southeast Asia-based scams skyrocket, costing Americans over $10 billion last year

WASHINGTON — Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) implemented sanctions against large network of scam centers across Southeast Asia that steal billions of dollars from Americans using forced labor and violence. The action includes nine targets operating in Shwe Kokko, Burma, a notorious hub for virtual currency investment scams under the protection of the OFAC-designated Karen National Army (KNA), as well as ten targets based in Cambodia.

“Southeast Asia’s cyber scam industry not only threatens the well-being and financial security of Americans, but also subjects thousands of people to modern slavery,” said Under Secretary of the Treasury for Terrorism and Financial Intelligence John K. Hurley. “In 2024, unsuspecting Americans lost over $10 billion due to Southeast Asia-based scams and under President Trump and Secretary Bessent’s leadership, Treasury will deploy the full weight of its tools to combat organized financial crime and protect Americans from the extensive damage these scams can cause.”

Today’s action targets the ownership structures and operators that perpetuate these scams and builds on a series of actions, including in the last several months, taken by Treasury to combat cyber scams and the serious human rights abuse that enables them. The sanctions authorities used today include Executive Order (E.O.) 13851, as amended by E.O. 13863 (“E.O. 13851, as amended”), which targets large transnational criminal organizations and their supporters; E.O. 13694, as amended by E.O. 14144 and E.O. 14306 (“E.O. 13694, as amended”), which targets actors engaged in malicious cyber-enabled activities; E.O. 13818, which targets those engaged in serious human rights abuse; and E.O. 14014, which targets persons who threaten the peace, security, and stability of Burma.

CYBER SCAMS TARGETING AMERICANS

Transnational criminal organizations (TCOs) based in Southeast Asia are increasingly targeting Americans through large-scale cyber scam operations. A U.S. government estimate reported Americans had lost at least $10 billion in 2024 to Southeast Asia-based scam operations, a 66 percent increase over the prior year. Southeast Asia-based criminal organizations often recruit individuals to work in scam centers under false pretenses. Using debt bondage, violence, and the threat of forced prostitution, the scam operators coerce individuals to scam strangers online using messaging apps or by sending text messages directly to a potential victim’s phone.

According to a September 2023 alert from Treasury’s Financial Crimes Enforcement Network (FinCEN) on virtual currency investment scams, the coerced perpetrators of these scams often use the promise of potential romantic relationships or friendships to gain the trust of their victims. They then convince their targets to make purported “investments” in virtual currency on websites that are designed to look like legitimate investment platforms, but are actually controlled by the scammers themselves. Ultimately, these scammers steal the funds deposited on the platforms. The scam operators specifically look to recruit individuals with English language skills to target American victims. Former scammers have reported that they were directed to specifically target Americans, and some even had quotas for the number of targets per day.

These designations follow multiple Treasury actions undertaken to combat these scams. On May 29, 2025, OFAC sanctioned Funnull, which sold IP (internet protocol) addresses in bulk to cybercriminals to operate scam websites. On May 5, 2025, OFAC designated the KNA as a TCO, along with its leader Saw Chit Thu and his two sons Saw Htoo Eh Moo and Saw Chit Chit, for their roles in facilitating cyber scams that harm U.S. citizens, human trafficking, and cross-border smuggling.

On May 1, 2025, FinCEN identified Huione Group, a southeast Asian financial institution, as a primary money laundering concern pursuant to section 311 of the USA PATRIOT Act. Huione Group has served as a critical node for laundering proceeds of cyber heists carried out by the Democratic People’s Republic of Korea (DPRK) and for TCOs in Southeast Asia perpetrating digital asset investment scams, commonly known as “pig butchering” scams, as well as other types of cyber scams. In September 2024, OFAC sanctioned Ly Yong Phat, his conglomerate L.Y.P. Group, and four of his hotels and resorts for their role in serious human rights abuse related to the mistreatment of trafficked workers in scam centers.

scam center IN shwe kokko

Treasury’s designations today target a major scam hub in Burma sheltered by the KNA. The KNA is headquartered in Shwe Kokko, Myawaddy Township, in Burma’s southeast Karen State along the border with Thailand. Through the KNA’s collaboration with the Burmese military, it gained control of territory in eastern Myanmar’s Karen State, where KNA leaders profit from transnational crime including cyber scam centers run with trafficked labor, and from the sale of utilities used to provide energy to those same scam operations.

Yatai New City is a prominent compound of scam centers in Shwe Kokko, created by She Zhijiang and Saw Chit Thu. In eight years, they transformed a small village on the Moei River into a resort city custom built for gambling, drug trafficking, prostitution, and scams targeting people around the world, particularly Americans. Scam operators at Yatai New City reportedly have lured recruits from around the world under false pretenses, only to detain and physically abuse them, while forcing them to work for crime syndicates as online scammers. Escaped victims have reported being held captive until ransoms are paid by their families, beaten for failing to make quotas, and forced into commercial sex work.

KNA INVOLVEMENT IN YATAI NEW CITY

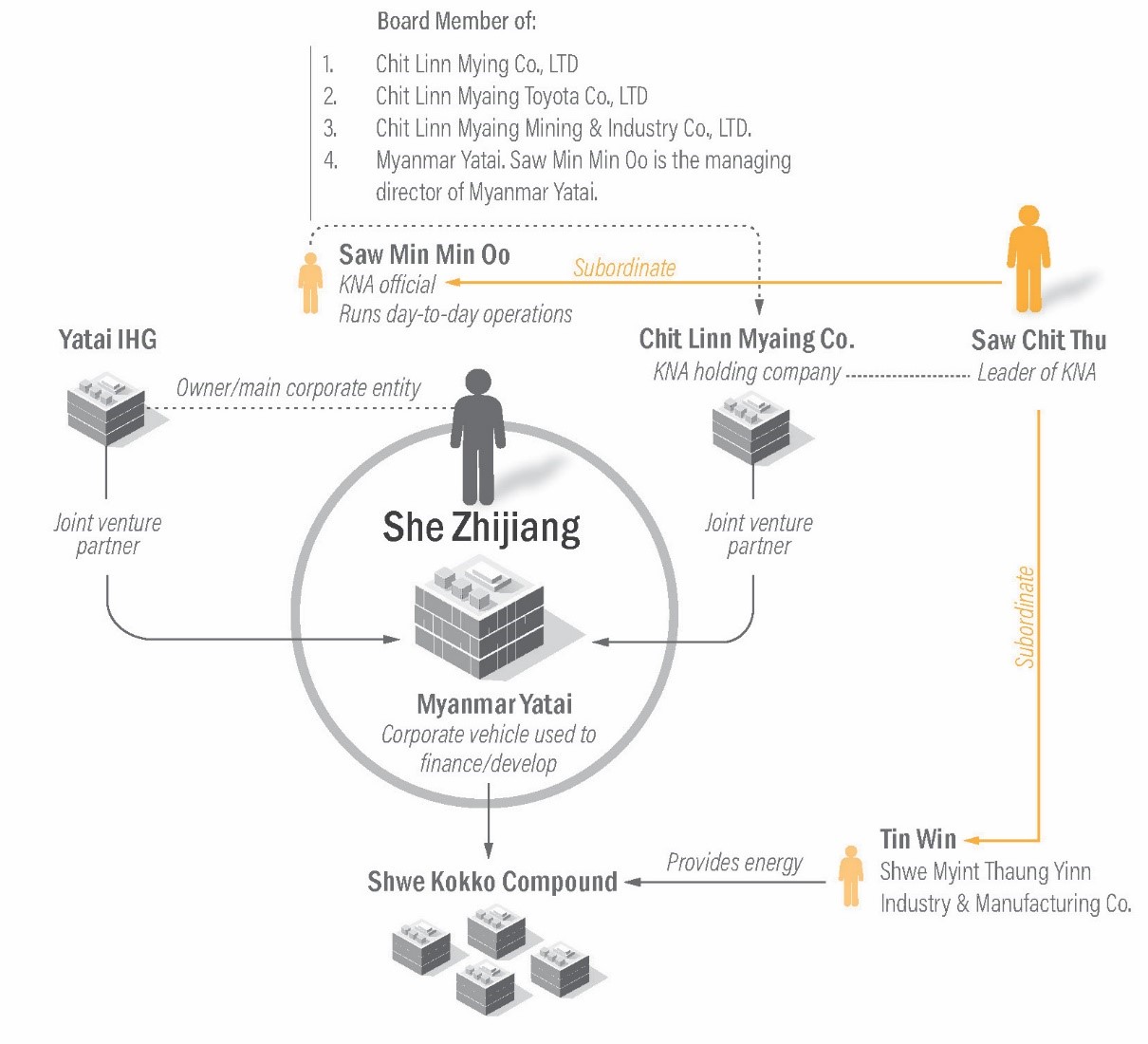

Saw Chit Thu, as the leader of the KNA, has entrusted different aspects of the operations to trusted subordinates, such as Tin Win and Saw Min Min Oo. Tin Win and Saw Min Min Oo control property that hosts the scam centers, provide security for those facilitating illicit money flows, and personally run entities that control and support scam compounds in Karen State.

Tin Win runs Shwe Myint Thaung Yinn Industry & Manufacturing Company Limited, the company that has historically contracted with energy suppliers to keep the lights on and the scams running in Shwe Kokko. In 2023 and 2025, Thailand shut off power to Yatai New City in an effort to close the scam centers down.

Saw Min Min Oo is a KNA official, and former Colonel in the KNA, who runs and manages various KNA affiliated companies. He is on the board of Chit Linn Mying Co., Ltd (CLM Co.), Chit Linn Myaing Toyota Company Limited, Chit Linn Myaing Mining & Industry Company Limited, and Myanmar Yatai International Holding Group Co., Ltd.

SHE ZHIJIANG’S SCAM CENTER EMPIRE

She Zhijiang is the creator and largest shareholder of the Yatai New City compound. Adopting Burmese and Cambodian citizenship, he has operated for years under a plethora of pseudonyms. In 2022, She Zhijiang was arrested in Thailand based on an Interpol Red Notice issued by China, which has continued to seek his extradition from Thailand ever since.

Myanmar Yatai International Holding Group Co., LTD. (Myanmar Yatai) is a joint venture between CLM Co., the KNA’s holding company, and She Zhijiang’s Yatai International Holdings Group Limited (Yatai IHG). This venture, which is 70 percent owned by Yatai IHG and 30 percent by CLM Co., owns, operates, and profits from Yatai New City and the scam activity happening within. Day-to-day business operations of Yatai New City are run in part by Managing Director Saw Min Min Oo. Yatai IHG is She Zhijiang’s main corporate vehicle for his business activities in Southeast Asia.

OFAC is designating Tin Win, Saw Min Min Oo, and Chit Linn Myaing Co., pursuant to E.O. 13581, as amended, and pursuant to E.O. 14014, for having acted or purported to act for or on behalf of, directly or indirectly, the Karen National Army.

OFAC is designating Chit Linn Myaing Toyota Company Limited and Chit Linn Myaing Mining & Industry Company Limited, pursuant to E.O. 13581, as amended, and pursuant to E.O. 14014, for having acted or purported to act for or on behalf of, directly or indirectly, Saw Chit Thu.

OFAC is designating Shwe Myint Thaung Yinn Industry & Manufacturing Company Limited pursuant to E.O. 13581, as amended, and pursuant to E.O. 14014 for having acted or purported to act for or on behalf of, directly or indirectly, Tin Win.

OFAC is designating She Zhijiang, Yatai International Holdings Group Limited, and Myanmar Yatai International Holding Group Co., Ltd pursuant to E.O. 13818, for being foreign persons who are responsible for or complicit in, or who have directly or indirectly engaged in, serious human rights abuse.

CASINOS-TURNED-CRIMINAL COMPOUNDS IN SIHANOUKVILLE

Treasury is also targeting groups of scam centers in Cambodia. Many of these centers were built as casinos by Chinese criminal actors but became hubs for virtual currency investment scams when that activity proved to be more profitable. T C Capital Co. Ltd. (T C Capital) is a company located in Sihanoukville, Cambodia that owns a complex of buildings, including the Golden Sun Sky Casino and Hotel, from which virtual currency scams and other illegal activities have been carried out, sometimes by victims of human trafficking. The complex’s casino functions also serve to launder the proceeds of the criminal activity taking place in adjacent buildings. T C Capital was founded by Dong Lecheng (Dong), an investor in several Sihanoukville real estate developments linked to modern slavery and virtual currency scams. Before moving to Cambodia, Dong was convicted of money laundering in China in 2008 and has been investigated for bribery, as well as for operating illegal online gambling rings advertised to Chinese nationals.

K B Hotel Co. Ltd. (K B Hotel) is another Sihanoukville company that owns a complex of buildings, including office blocks and a hotel and casino, where enslaved workers are forced to conduct virtual currency scams. K B Hotel was co-founded by Xu Aimin (Xu), a naturalized Cambodian citizen who has used his relationships with politically connected Cambodian individuals to avoid scrutiny for K B Hotel and his other businesses. Before moving to Cambodia, Xu was sentenced to 10 years in prison in China in 2013 for operating an illegal billion-dollar online gambling ring, was the subject of an INTERPOL Red Notice, and was wanted in Hong Kong for laundering $46 million of the proceeds through its banks. Xu also owns K B X Investment Co. Ltd. (K B X Investment), a Cambodian real estate development company.

CYBER SCAM NETWORKS ACROSS CAMBODIA

Another member of K B Hotel’s board is Chen Al Len (Chen), who is also a director of Heng He Bavet Property Co. Ltd. (Heng He Bavet). Heng He Bavet owns the Heng He Casino and an associated complex of buildings in Bavet, Cambodia. The company, which is involved in virtual currency scams and forced labor, has received workers from Sihanoukville who were previously linked to cyber scams. Heng He Bavet is co-directed by Su Liangsheng (Su), who also sits on the board of M D S Heng He Investment Co. Ltd. (M D S Heng He). M D S Heng He is the developer of a large virtual currency scam compound in Pursat Province in Cambodia. The company is chaired by Try Pheap, a Cambodian tycoon previously designated by OFAC. Additionally, Chen and Su are together the majority owners of HH Bank Cambodia plc (HH Bank), a Cambodian financial institution.

OFAC is designating T C Capital, K B Hotel, Heng He Bavet, M D S Heng He, Dong, Xu, Chen, and Su pursuant to E.O. 13694, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of cyber-enabled activities originating from, or directed by persons located, in whole or substantial part, outside the United States that is reasonably likely to result in, or has materially contributed to, a threat to the national security, foreign policy, or economic health or financial stability of the United States and that have the purpose of or involve causing a misappropriation of funds or economic resources, intellectual property, proprietary or business confidential information, personal identifiers, or financial information for commercial or competitive advantage or private financial gain.

OFAC is designating K B X Investment pursuant to E.O. 13694, as amended, for being owned or controlled by, or having acted or purported to act for or on behalf of, directly or indirectly, Xu. OFAC is designating HH Bank pursuant to E.O. 13694, as amended, for being owned or controlled by, or having acted or purported to act for or on behalf of, directly or indirectly, Chen, and also pursuant to E.O. 13694, as further amended, for being owned or controlled by, or having acted or purported to act for or on behalf of, directly or indirectly, Su.

GLOBAL MAGNITSKY

Building upon the Global Magnitsky Human Rights Accountability Act, E.O. 13818 was issued on December 20, 2017, in recognition that the prevalence of human rights abuse and corruption that have their source, in whole or in substantial part, outside the United States, had reached such scope and gravity as to threaten the stability of international political and economic systems. Human rights abuse and corruption undermine the values that form an essential foundation of stable, secure, and functioning societies; have devastating impacts on individuals; weaken democratic institutions; degrade the rule of law; perpetuate violent conflicts; facilitate the activities of dangerous persons; and undermine economic markets. The United States seeks to impose tangible and significant consequences on those who commit serious human rights abuse or engage in corruption, as well as to protect the financial system of the United States from abuse by these same persons.

SANCTIONS IMPLICATIONS

As a result of today’s action, all property and interests in property of the designated or blocked persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of blocked persons.

Violations of U.S. sanctions may result in the imposition of civil or criminal penalties on U.S. and foreign persons. OFAC may impose civil penalties for sanctions violations on a strict liability basis. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. economic sanctions. In addition, financial institutions and other persons may risk exposure to sanctions for engaging in certain transactions or activities involving designated or otherwise blocked persons. The prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any designated or blocked person, or the receipt of any contribution or provision of funds, goods, or services from any such person.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, or to submit a request, please refer to OFAC’s guidance on Filing a Petition for Removal from an OFAC List.

Click here for more information on the persons designated today. To report internet crime to the FBI, click here.

###