By: Assistant Secretary for Economic Policy Ben Harris and Deputy Assistant Secretary for Macroeconomics Neil Mehrotra

One of the most important macroeconomic issues surrounds the current state of U.S. growth. Concerns about recession risks largely arise from the 1.6 percent decline in U.S. gross domestic product (GDP) last quarter, largely due to unique and technical factors, and the observation that tracking estimates suggest that GDP may have contracted in the second quarter. However, considerable evidence suggests that the economy is not currently in a recession, including persistent strength in the labor market, expanding industrial production, and alternative estimates of economic growth that suggest rapid expansion.

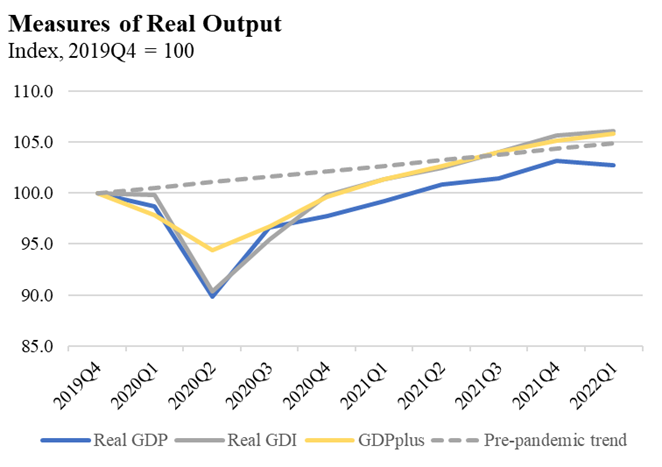

In this blog, we revisit one important piece of evidence that shows stronger growth for the U.S. economy – the continued divergence between gross domestic product and gross domestic income (GDI). As we detailed in our previous blog, gross domestic income shows a faster recovery in U.S. output over the pandemic, resulting in a historically large discrepancy between the two series. This divergence further widened in the first quarter of 2022, when real GDI increased while real GDP contracted. Available data for the second quarter suggests that this pattern may continue. The advance estimate for 2022Q2 GDP will be released later this week, on Thursday, July 28th, and will provide additional insight on the current state of the economy.

Understanding Last Quarter’s Divergence Between GDI and GDP

Last quarter’s divergence between GDP and GDI raises several important questions about underlying trends in the economy. Here, we discuss three: whether the data suggest productivity is rising or falling; whether falling GDP may be due to the nature of goods and services produced; and what alternative measures of output can tell us about growth.

An important implication of the macroeconomic growth data concerns trends in productivity. If American workers and businesses had become less productive, that should show up as lower income through some combination of lower wages or lower profits. As of the most recent revision, U.S. real GDP fell 1.6 percent (annualized rate) in the first quarter of 2021 despite adding 1.7 million jobs. Taken at face value, this suggests a sharp decline in labor productivity – where U.S. corporations and firms produced less goods and services despite having more Americans working.

However, the data on gross domestic income does not bear that out for the first quarter. While corporate profits fell in the first quarter, this decrease was virtually entirely due to a decline in profits from financial firms, as non-financial corporate profits remained flat. At the same time, other business income grew modestly, and labor income surged over 11 percent (annualized rate).[1] Gains in labor income were more modest once adjusted for inflation, but remained positive, accounting for the strong 1.8 percent growth in real GDI. The combination of rising wages, rising industrial production, and high non-financial corporate profits are not suggestive of a sharp decline in productivity.

We now turn to the question of whether falling GDP may be due to the type of goods and services produced. An important observation here is that, in addition to rising GDI, the first quarter saw an increase in real gross output of 2.0 percent (annualized rate). Relative to GDP, gross output is a broader measure of economic activity in that it not only includes “final” goods and services produced, but “intermediate” goods and services as well. An example of intermediate goods would be the parts produced by an auto manufacturer that would ultimately go into a new car. To avoid double counting the creation of value, GDP counts only the value of the car itself and not the parts used to construct it.

The fact that real gross output grew in the first quarter helps reconcile the observed gain in employment; more workers did indeed produce more “stuff.” Rather, the Bureau of Economic Analysis (BEA) finds that more of gross output went to intermediate goods rather than final goods. Put another way, the U.S. economy produced fewer final goods but more intermediate goods, which should eventually beget more future final goods.

It is possible that the gross output data points to a decline in productivity as more intermediate goods were required to produce less final output. However, timing issues may be leading to discrepancies between gross output, GDP, and GDI. The surge in intermediate goods in the gross output data along with a sharp rise in imports in the month of March may reflect difficulties in tracking goods due to a strained supply chain. For example, if an imported consumer good is finally brought ashore and counted by customs but has not yet reached a wholesaler or retailer, the negative contribution to GDP will be recorded but the offsetting positive contribution to inventories is not.

Lastly in this section, we turn to the question of alternative measures of output. As noted in our previous blog, the simple average of GDP and GDI provides a rule of thumb to infer the true rate of economic growth. This gross domestic output (GDO) – the average of GDI and GDP – grew at just 0.1 percent in the first quarter. However, there may be a better way to extract underlying output growth from noisy indicators like GDP and GDI.

A sophisticated measure of growth, termed GDPplus, suggests even stronger growth in the first quarter of 2022. GDPplus was created by economists at the Federal Reserve Bank of Philadelphia to tease out measurement errors by attempting to extract the true underlying level of growth using both GDP and GDI as imperfect measures of growth and how measurement errors in each of these series are typically revised over time.[2] GDPplus grew at 2.7 percent in the first quarter – faster than GDP, GDI, and gross output.

Income Growth in the Second Quarter

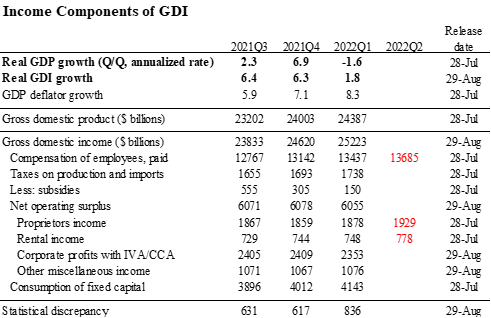

The divergence between GDI and GDP in the first quarter may continue into the second quarter as the expansion in GDI is expected to continue. While the first estimate for GDP for 2022Q2 will be released later this week, the first estimate for GDI for the quarter is only available in at the end of August. However, some of the series that go into GDI are already available or will be released along with the advance estimate for GDP. As the table below shows, estimates suggest continued positive growth for those categories of income.

The largest component of GDI is labor income, comprising approximately 55 percent of GDI. The U.S. economy added 1.3 million jobs in 2022Q2 according to the payroll survey and 429,000 jobs according to the household survey. The payroll survey shows continued increases in labor income: aggregate weekly payrolls for private sector employs rose 1.7 percent in the second quarter. Likewise, data from monthly personal income shows compensation to employees rose 0.6 percent (month-on-month) in April and 0.5 percent (month-on-month) in May. If compensation to employees grows at 0.5 percent in June, that would imply a 1.8 percent rise in labor income.

Of course, these estimates are for nominal labor income and need to be adjusted for inflation. The GDP deflator rose 2.0 percent (not annualized) in the first quarter, and we anticipate a slightly slower rate of increase in the second quarter of around 1.8 percent. Together, this suggests that real labor income was roughly flat in second quarter.

The business income component of GDI is generally harder to track in real time. However, monthly estimates of both rental income and proprietors’ income are reported in monthly personal income. These two components make up about 10 percent of GDI. Both components have risen faster in the second quarter relative to the first quarter. For these components, 2.5 to 3.0 percent growth (quarter-on-quarter) appears likely; after adjusting for inflation, these components would remain positive, increasing real GDI. By contrast, corporate profits fell in the first quarter and otherwise lowered GDI growth. Corporate profits before taxes, which also comprise roughly 10 percent of GDI, fell 2.3 percent (quarter-on-quarter) in 2022Q1 on lower profits at domestic financial firms.

Corporate income as measured by the BEA has several differences from corporate earnings as reported to Wall Street. First, the BEA seeks to measure domestic earnings rather than global earnings. Earnings must also be adjusted for depreciation and adjusted for capital gain or losses on sales from inventory. Given labor income and other business income, it is likely that a sharp decline in corporate earnings (on order of 8-10 percent quarter-on-quarter) would be needed to generate a decline in real GDI commensurate to current tracking estimates of real GDP (-1 to -2 percent in Q2).

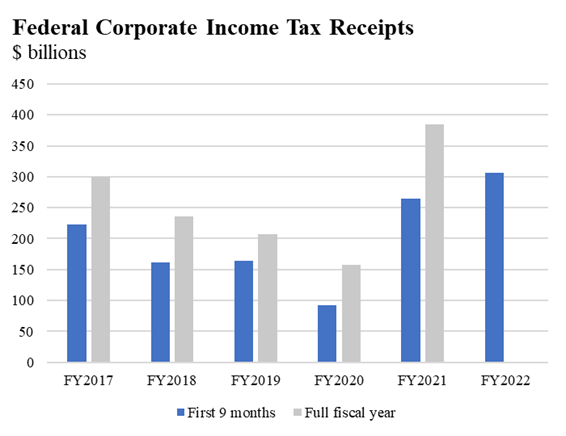

Corporate income tax receipts do not currently suggest a large decline in corporate profits. Corporate income tax receipts totaled $179 billion in Q2 and exceeds $300 billion for the FY 2022 so far (from September 2021 to June 2022).[3] This is higher than corporate tax receipts in 2021 at the same point ($265 billion) and is up sharply relative to pre-pandemic levels. Corporate tax receipts in 2018 and 2019 at the same point were $162 billion and $164 billion, respectively. Overall, tax receipts suggest continued strong growth in corporate income. Even after converting to real terms (relative to 2019, the GDP deflator has risen 10 to 12 percent), the rise in corporate tax receipts is sizable.

Summing Up

Underlying estimates of economic growth are noisy and subject to revision, often months or years after the initial release. As a result, to get an accurate real-time read on the economy, economists need to look across several measures of economic activity to infer the true pace of growth. The divergence in GDP and GDI over the pandemic period, with GDI showing a substantially faster recovery over the pandemic and continued expansion in the first quarter, has complicated this task. On the whole, our view is that the data strongly suggest we are not currently in a recession, and that this year’s first quarter growth was likely favorable when looking at income, employment, and overall production. Looking forward, initial reads on the income data suggest that this growth continued into the second quarter of 2022.

[1] The decline in domestic corporate profits in Q1 was due mostly to a decline in profits of financial firms (from $550 billion to $500 billion). Nonfinancial domestic corporate profits were nearly unchanged ($1.86 trillion to $1.85 trillion). Source: NIPA Table 6.16D.

[2] See https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/gdpplus and Aruoba, S.B., F.X. Diebold, J. Nalewaik, F. Schorfheide, and D. Song (2016), "Improving GDP Measurement: A Measurement-Error Perspective," Journal of Econometrics, 191, pp. 384-397.

[3] Source: June Monthly Treasury Statement, US Treasury: https://fiscal.treasury.gov/files/reports-statements/mts/mts0622.pdf