WASHINGTON – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) took action against 25 individuals and entities, including a network of Iran, UAE, and Turkey-based front companies, that have transferred over a billion dollars and euros to the Islamic Revolutionary Guard Corps (IRGC) and Iran’s Ministry of Defense and Armed Forces Logistics (MODAFL), in addition to procuring millions of dollars’ worth of vehicles for MODAFL. Today’s action exposes an extensive sanctions evasion network established by the Iranian regime, which it increasingly relies on as the United States’ maximum pressure campaign severely constricts the regime’s sources of revenue. OFAC also designated Iran’s MODAFL pursuant to Executive Order (E.O.) 13224 for its role in assisting the IRGC-Qods Force (IRGC-QF), as well as an Iran-based bank for providing banking services to the IRGC-QF.

“We are targeting a vast network of front companies and individuals located in Iran, Turkey, and the UAE to disrupt a scheme the Iranian regime has used to illicitly move more than a billion dollars in funds,” said Treasury Secretary Steven T. Mnuchin. “The IRGC, MODAFL, and other malign actors in Iran continue to exploit the international financial system to evade sanctions, while the regime funds terrorism and other destabilizing activities across the region.”

“Central to this network and sanctioned today pursuant to our counterterrorism authority is Iran's IRGC-controlled Ansar Bank and its currency exchange arm, Ansar Exchange, both of which used layers of intermediary entities to exchange devalued Iranian rial ultimately for dollars and euros to line the pockets of the IRGC and MODAFL. This vast network is just the latest example of the Iranian regime’s use of deceptive practices to exploit the global financial system and divert resources to sanctioned entities,” said Treasury Under Secretary for Terrorism and Financial Intelligence Sigal Mandelker. “This once again exposes to the international community the dangerous risks of operating in an Iranian economy that is deliberately opaque.”

Ansar Bank’s Sanctions Evasion Scheme

Through IRGC-controlled Ansar Bank, the Iranian regime established a layered network of front companies based in Iran, Turkey, and the UAE to bypass sanctions, gain access to the international financial system, and exchange devalued Iranian rial for dollars and euros. Ansar Bank also used international free zones to establish front companies.

As part of this scheme, Ansar Bank used its Iran-based foreign currency arm, Ansar Exchange and its network, to convert Iranian rial ultimately to hundreds of millions of dollars and euros. To provide this funding to Ansar Bank, MODAFL, and the IRGC, Ansar Exchange relied upon a network of front companies and agents in Turkey and the UAE. In just the last year-and-a-half, four front companies- UAE-based Sakan General Trading, Lebra Moon General Trading, and Naria General Trading, as well as Iran-based Hital Exchange, all designated today — provided the equivalent of approximately $800 million in funds to Ansar Exchange. Additionally, Turkey-based Atlas Doviz acted as a secondary foreign currency provider for Ansar Exchange.

These front companies are witting to Iran’s sanctions evasion. For example, as of 2019, Ansar Exchange Managing Director Alierza Atabaki worked closely with one central procurement agent, Reza Sakan, to avoid the scrutiny of Emirati authorities regarding Ansar Exchange’s financial dealings with UAE-based Sakan General Trading and other identified Ansar Exchange intermediaries.

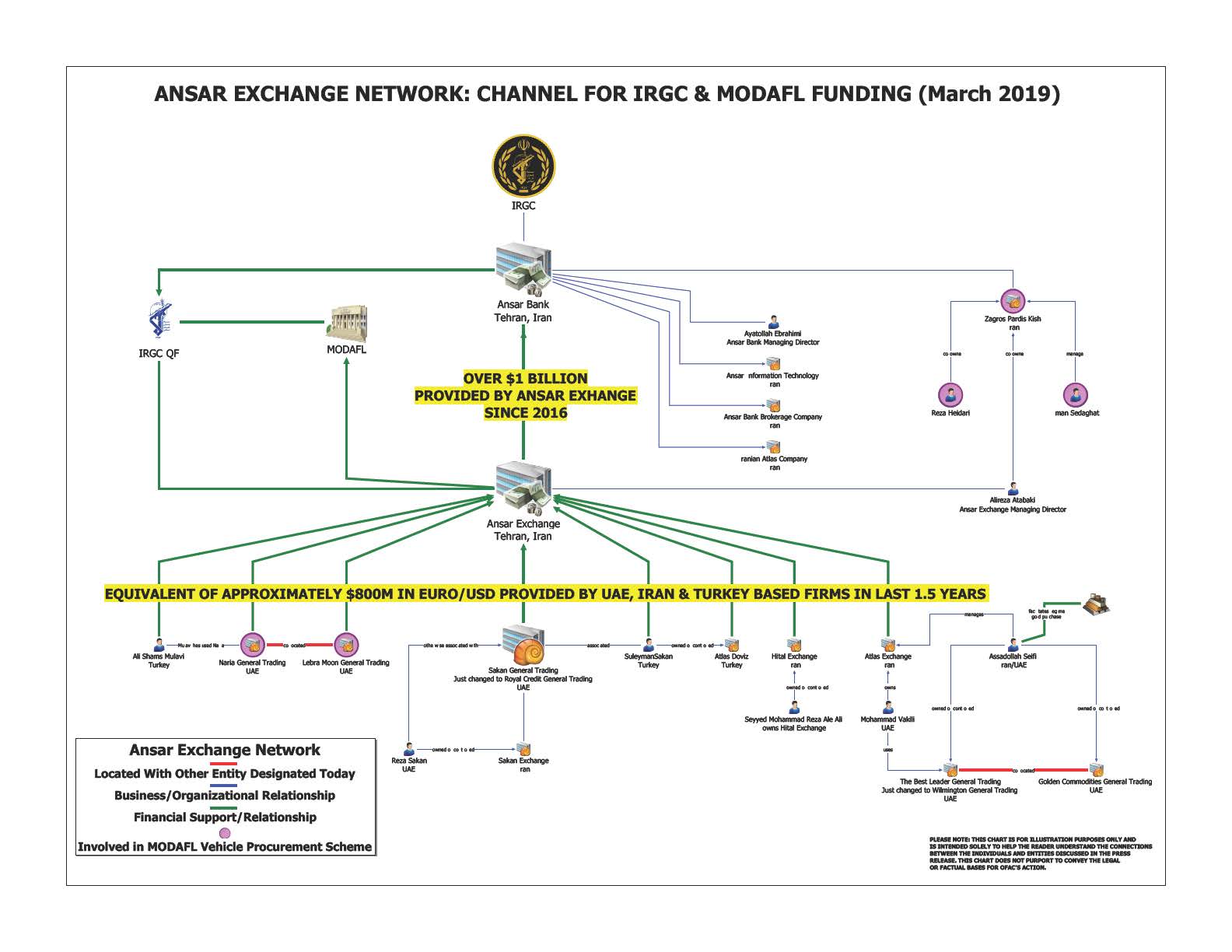

View the chart in Farsi describing Ansar Bank’s sanctions evasion scheme.

MODAFL, Ansar Bank, and Its Iran-Based Subsidiaries

MODAFL

MODAFL, first designated in 2007 pursuant to E.O. 13382 for supporting persons involved in Iran’s proliferation activities, supervises Iran’s development and production of missiles, including those used by Iran-backed Houthi militias in Yemen against coalition forces. Today, OFAC designated MODAFL for providing logistic support to the IRGC-QF and its regional proxy groups. Specifically, MODAFL was designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, the IRGC-QF.

As of 2017, MODAFL used funds from the Central Bank of Iran (CBI) that were earmarked for the IRGC-QF.

As a part of this scheme, multiple UAE-based firms were involved in the acquisition of hundreds of vehicles by MODAFL, an endeavor that also involved Iran-based Zagros Pardis Kish and Reza Heidari, who was designated pursuant to E.O. 13224 on November 20, 2017 for acting for or on behalf of, and for providing support to, the IRGC-QF as a part of a large-scale IRGC-QF counterfeiting ring. Payment for these vehicles was made to Lebra Moon General Trading. Naria General Trading was also involved in the vehicle acquisition.

Ansar Bank and Ayatollah Ebrahimi

IRGC-controlled Ansar Bank was previously designated pursuant to E.O. 13382 in 2010. Today, OFAC designated Ansar Bank pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, the IRGC-QF, and for being owned or controlled by the IRGC. With 1,081 branches throughout Iran, Ansar Bank procured hundreds of millions of dollars in the last three years on the IRGC’s behalf.

As recently as 2019, Ansar Bank officials maintained close associations with senior IRGC-QF officials and financial facilitators who use accounts at Ansar Bank to keep the equivalent of millions of dollars. For example, Treasury-designated IRGC-QF financial facilitator Meghdad Amini held funds at Ansar Bank.

Ansar Bank also extended the equivalent of millions of dollars as a loan to an IRGC-QF front company. IRGC-QF officials’ salaries also have been paid using Ansar Bank, and Ansar Bank is used by the IRGC-QF to pay the salaries of its foreign fighters, particularly those based in Syria. On October 16, 2018, Treasury designated two of these Syria-based, IRGC-QF-backed militias, the Fatemiyoun Division and Zainabiyoun Brigade, which are comprised of foreign fighters, including child soldiers as young as 14 years old.

Ayatollah Ebrahimi, who was recruited into the IRGC at the age of 14, has been the managing director of Ansar Bank since 2005. In this capacity, Ebrahimi worked directly with IRGC-QF officials to facilitate their financial activities, including the conversion of euros or the UAE dirham for the terrorist group. Ayatollah Ebrahimi is being designated pursuant to E.O. 13224 for acting for or on behalf of Ansar Bank.

Treasury is also taking action against a number of Iranian firms owned, or under the control of, Ansar Bank. Specifically, Iranian Atlas Company, Ansar Bank Brokerage Company, and Ansar Information Technology are being designated pursuant to E.O. 13224 for being owned or controlled by Ansar Bank.

Ansar Exchange and Its Network of Procurement Agents

Ansar Exchange

Central to this foreign currency procurement network is Iran-based Ansar Exchange, which conducted significant volumes of foreign currency exchange services for sanctioned Iranian entities, including Ansar Bank, MODAFL, and the IRGC. Ansar Exchange is wholly owned and controlled by Ansar Bank.

Since 2016, Ansar Exchange conducted currency exchange services for Ansar Bank totaling over one billion dollars. Over the past few years, Ansar Exchange also directly provided MODAFL with the equivalent of approximately 100 million in dollars and euros, in addition to the equivalent of approximately 130 million dollars’ worth of goods and services ultimately destined for the benefit of the IRGC.

As recently as 2019, Ansar Exchange maintained a close association with senior IRGC-QF officials. Ansar Exchange is being designated pursuant to E.O. 13224 for being owned or controlled by Ansar Bank, and for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Bank. Ansar Exchange is also being designated for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, the IRGC-QF, and for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, the IRGC.

Alireza Atabaki

Alireza Atabaki is the managing director of Ansar Exchange. He co-owns Zagros Pardis Kish with Reza Heidari, an individual designated by Treasury in 2017 for acting for or on behalf of, and providing support to, the IRGC-QF. As recently as early 2019, Atabaki has worked with the IRGC-QF and coordinated transactions using an identified IRGC-QF front company.

Alireza Atabaki is being designated pursuant to E.O. 13224 for acting for or on behalf of Ansar

Exchange.

In 2018, Iran-based Atlas Exchange — also designated today — at the behest of Atabaki, paid hundreds of thousands of euros and dirham to companies in Europe and the UAE. In 2018 and 2019, Atabaki worked closely with UAE-based Iranian financial facilitator Reza Sakan and UAE-based Mohammad Vakili, both of whom are being designated today. Vakili is affiliated with UAE-based companies Best Leader General Trading LLC and Golden Commodities General Trading LLC. Since at least 2015, Atabaki, in coordination with Iranian financial facilitator Assadollah Seifi, used Vakili and his UAE-based companies as foreign currency procurement and financial facilitation agents to procure and transfer millions of dollars, including in cash.

Zagros Pardis Kish

Ansar Exchange’s Managing Director Atabaki and Reza Heidari are registered as the co-owners of Zagros Pardis Kish, a company that is wholly owned by Ansar Bank. Ansar Exchange lists Zagros Pardis Kish as one of its major foreign currency customers.

Zagros Pardis Kish was involved in MODAFL’s acquisition of hundreds of vehicles shipped from the UAE to Iran. Multiple UAE-based firms were used to pay for and ship the vehicles. Reza Heidari and Zagros Pardis Kish manager Iman Sedaghat were involved in this endeavor. Zagros Pardis Kish is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of MODAFL, and for being owned or controlled by Alireza Atabaki.

In his capacity as manager of Zagros Pardis Kish, Iman Sedaghat coordinated the purchase of the hundreds of vehicles for MODAFL through the UAE for millions of dollars. Iman Sedaghat was previously involved in working with the IRGC-QF. Iman Sedaghat is being designated pursuant to E.O. 13224 for acting for or on behalf of Zagros Pardis Kish, and for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, MODAFL.

UAE- and Turkey-Based Front Companies

Sakan General Trading and Reza Sakan

Among the UAE-based companies sanctioned today, UAE-based Sakan General Trading provided the most foreign currency exchange support to Ansar Exchange, and is owned by UAE resident and Iranian national Reza Sakan and his Iran-based firm Sakan Exchange, also known as Joint Partnership of Reza Sakan Dastgiri and Associates. Sakan General Trading was involved in financing the purchase of military aircraft tires by Iran’s Pars Aviation Service Company for the Syrian Air Force.

Sakan General Trading recently changed its name to Royal Credit General Trading.

Sakan General Trading is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Exchange. Reza Sakan is being designated pursuant to E.O. 13224 for being otherwise associated with Sakan General Trading, as he owns or controls Sakan General Trading. Sakan Exchange is also being designated pursuant to E.O. 13224 for being owned or controlled by Reza Sakan.

Hital Exchange and Seyyed Mohammad Reza Ale Ali

Hital Exchange, also known as Seyyed Mohammad Reza Ale Ali Currency Exchange, provided a significant volume of euros and dollars to Ansar Exchange. It is owned by Iranian national Seyyed Mohammad Reza Ale Ali who worked directly with Ansar Exchange Managing Director Alireza Atabaki to convert foreign currency.

From October 2016 to March 2018, Mohammad Reza Ale Ali, using Hital Exchange, provided Ansar Exchange with the equivalent of approximately $180 million in euro and U.S. dollar banknotes.

Today, Mohammad Reza Ale Ali is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Exchange. Hital Exchange is also being designated pursuant to E.O. 13224 for being owned or controlled by Mohammad Reza Ale Ali.

Atlas Exchange and Mohammad Vakili

Ansar Exchange also used Iran-based Atlas Exchange and its brokers to procure foreign currency. During the latter half of 2018, Ansar Exchange directed Atlas Exchange to transfer hundreds of thousands of euros and dirham to an Iranian company in the UAE and four companies in Europe. As of early 2019, Atlas Exchange solicited business with sanctioned Iranian banks. Atlas Exchange is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Exchange.

Atlas Exchange is owned by Mohammad Vakili, who resides in the UAE and collaborated with Assadollah Seifi to use two UAE-based companies – the Best Leader General Trading and Golden Commodities General Trading – to evade sanctions. Since at least 2015, Attabaki (Ansar Exchange’s managing director) in coordination with Assadollah Seifi used Vakili and his affiliated UAE-based companies, the Best Leader General Trading and Golden Commodities, to procure and transfer millions of dollars including in cash. The Best Leader General Trading recently changed its name to Wilmington General Trading.

As recently as late 2018, Atabaki (Ansar Exchange’s managing director) coordinated closely with Mohammad Vakili on financial matters. Vakili effectuated multiple transfers worth hundreds of thousands of dollars to entities in the UAE and Turkey on behalf of Atabaki, who has instructed Vakili to increase certain deposits for companies affiliated with the scheme. Mohammad Vakili is being designated pursuant to E.O. 13224 for acting for or on behalf of Alireza Atabaki.

Asadollah Seifi, Golden Commodities General Trading, and The Best Leader General Trading

Asadollah Seifi used UAE-based Golden Commodities, which is under his supervision, and UAE-based company The Best Leader General Trading, to obfuscate millions of dollars’ worth of transactions benefiting the Iranian regime. Seifi also manages Atlas Exchange, and his procurement of U.S. dollars involved the transfer of funds through U.S.-designated banks such as Bank Mellat and Europaisch-Iranische Handelsbank AG. In August 2018, Seifi also facilitated the purchase of gold by the Iranian regime after U.S. sanctions on Iranian gold had been reimposed.

Seifi has also facilitated the purchase of foreign currency for the IRGC.

Assadolah Seifi is being designated pursuant to E.O. 13224 for acting for or on behalf of Atlas Exchange. Golden Commodities General Trading LLC is being designated pursuant to E.O. 13224 for being owned or controlled by Asadollah Seifi. The Best Leader General Trading is being designated pursuant to E.O. 13224 for being owned or controlled by Asadollah Seifi.

Suleyman Sakan and Atlas Doviz Ticaret A.S.

Since 2017, Turkey-based Suleyman Sakan, who is affiliated with Turkish firm Atlas Doviz Ticaret A.S., provided millions of U.S. dollars in foreign currency exchange services to Ansar Exchange, including through Turkey-based Atlas Doviz. Suleyman Sakan is an associate of Reza Sakan and UAE-based Sakan General Trading. Since at least 2017, Suleyman Sakan worked with Reza Sakan to expand their business activities to Oman using the Omani financial sector.

Suleyman Sakan is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Exchange.

Atlas Doviz Ticaret A.S. is being designated pursuant to E.O. 13224 for being owned or controlled by Suleyman Sakan.

Ali Shams Mulavi

Since 2017, another Ansar Exchange intermediary agent, Turkey-based Iranian financial facilitator Ali Shams Mulavi, has used Naria General Trading to purchase foreign currency on behalf of Ansar Exchange. In 2019, Ali Shams Mulavi procured and transferred U.S. dollar banknotes for Ansar Exchange.

Ali Shams Mulavi is being designated pursuant to E.O. 13224 for assisting, sponsoring, or providing financial, material, or technological support for, or financial or other services to or in support of, Ansar Exchange.

Sanctions Implications

As a result of today’s action, all property and interests in property of these targets that are in the United States or in the possession or control of U.S. persons must be blocked and reported to OFAC. OFAC’s regulations generally prohibit all dealings by U.S. persons or within the United States (including transactions transiting the United States) that involve any property or interests in property of blocked or designated persons.

In addition, persons that engage in certain transactions with the individuals and entities designated today may themselves be exposed to sanctions or subject to an enforcement action. Furthermore, unless an exception applies, any foreign financial institution that knowingly facilitates a significant transactions for any of the individuals or entities designated today could be subject to U.S. sanctions.

View the chart in English or Farsi describing Ansar Bank’s sanctions evasion scheme.

####