HAF Participants that have expended most of their award funds often begin to plan for closeout, even if the program is still actively serving homeowners.[1] To support this process, Treasury created a HAF Closeout Resource to help participants ensure that the award objectives were met and all administrative activities are completed. As a reminder, the period of performance for the HAF award ends on September 30, 2026.[2]

HAF Participants considering early closeout of their HAF award can consider a few practices to ensure that this process goes smoothly and sets up homeowners and other partners for success in the future. Ensure that your team is ready to initiate early closeout of the HAF award by reviewing the following tips.

1. Think Ahead for Expenditures and Partners

- Consider utilizing housing counseling resources (limited to an aggregate amount up to 5% of the total HAF award amount as set forth in the HAF Guidance[3]) as a point of contact to help direct homeowners to available resources once HAF mortgage assistance is no longer available. This can include references to local HUD Certified Counselors on your website. Please note that recipients cannot use HAF funds for any housing counseling that occurs after the end of the award term (or the initiation of early closeout).

- Reach out to partners, government agencies and organizations that serve homeowners in need to identify potential services that can support homeowners after the HAF award expires.

- Consider how to retain data related to your HAF award, determine whether you meet the requirements to conduct a single or program-specific audit for your current fiscal year and pay the staff necessary for these activities before HAF award funds are no longer available to be obligated or expended. Consider the timing of these activities and budget for these expenditures prior to initiating early closeout and submitting the final reports. HAF participants are not permitted to expend any HAF award funds after initiating early closeout. For those engaging in standard closeout, ensure that a plan is in place and obligate the appropriate amount of HAF award funds for administrative expenses related to award closeout activities prior to the end of the Period of Performance (POP).

2. Communication is Key

- Be sure to communicate with partners, servicers, and other vendors associated with your HAF program in advance of announcing your program winddown. This will help the public plan for any uptick or slowdown in application submissions as well as applicants who may not be eligible.

- Provide a list of resources for homeowners on your webpage as soon as your application portal closes. Ensure to include resources and links to partners that can help homeowners find other sources of assistance after your HAF award is expired.

- Be sure that homeowners are aware of when your program will winddown and wait list procedures. Setting expectations in advance is key to retaining trust with the public. Update your website, social media, and other channels.

3. Prepare Finances

- Review your budget in Treasury’s Portal and ensure it accurately reflects the HAF participant’s actual HAF award budget. Verify that the total expenditures and obligations align with the total (net) award amount. While Participants may make adjustments to their budgets through Treasury’s Portal, these changes must be submitted to Treasury for approval prior to submitting their Final Reports for closeout.

- If the participant has any unobligated balances by the end of the Period of Performance (POP) or unliquidated obligations by the end of the liquidation period, review the section of the HAF Closeout Resource on Repayment of HAF award funds.

- Review the total amount expended on administrative expenses including planning, community engagement and needs assessment. This amount is limited to 15% of the total HAF award amount as set forth in the HAF Guidance.[4]

- Review the total amount expended on housing counseling and legal services. This amount is limited to an aggregate amount up to 5% of the total HAF award amount as set forth in the HAF Guidance.[5]

4. Complete Closeout Activities

- The list of activities listed below generally outlines the requirements for HAF Closeout. The order and deadlines associated with these activities depends on if the participant is opting for early closeout or standard closeout. See the HAF Closeout Resource for more information.

- reconcile financial expenditures associated with the HAF award.

- liquidate all HAF award obligations incurred by September 30, 2026.

- determine whether any balances of unobligated and unexpended funds remain on the HAF award that must be returned to Treasury.

- determine the status of all real and tangible personal property and unused supplies purchased with HAF award funds.

- prepare and submit the required Final Closeout Reports and any additional requested documents to Treasury.

5. Invest in the Future

- Collect lessons learned and promising practices gained from the HAF award. Share these with Treasury, local government agencies and non-profits that support homeowners in need of assistance.

- For participants planning to continue homeowner assistance using HAF-like programs, use HAF lessons learned and infrastructure that has been developed to continue the legacy of Treasury’s HAF program. This could include the participant’s email addresses and website, partnership contacts, technological platforms and contracts, and other existing infrastructure.

6. Celebrate your HAF Impact!

- Highlight the great work your HAF team has accomplished supporting homeowners financially impacted by the pandemic by sharing data and, with permission, stories from homeowners. Share these stories through local news channels and social media. Tag various partners, non-profits, and vendors who contributed to the success of your HAF program. Even tag Treasury![6]

- Collaborate with partners – non-profits, vendors, and agencies – to uplift the great work that was accomplished over the course of the period of performance of your HAF award.

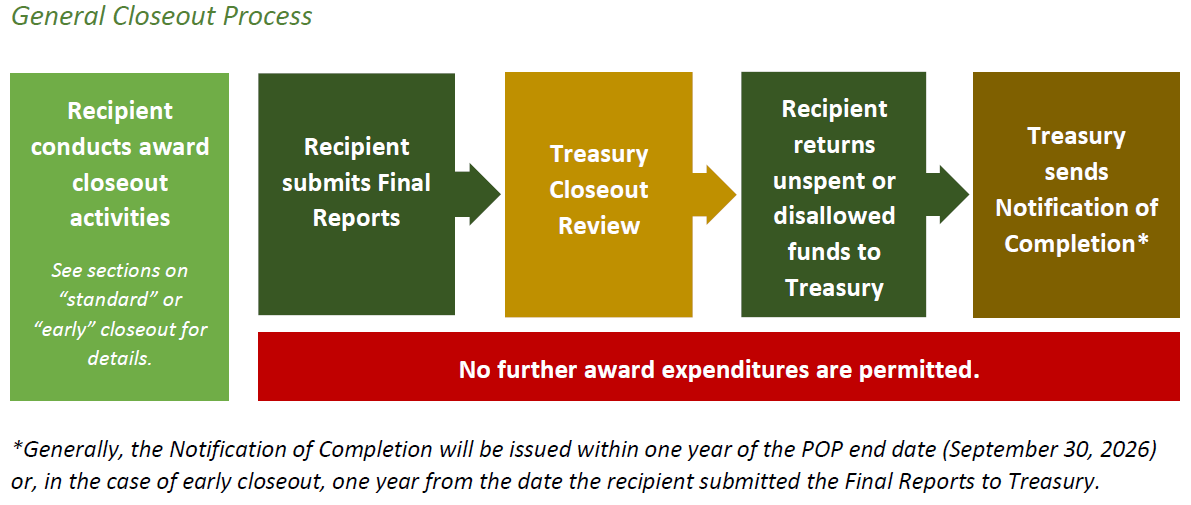

[1] Closeout is the process by which the federal awarding agency (Treasury) determines that the participant has completed all applicable administrative actions and required work of the federal award have been completed.

[2] The period of performance for the HAF award is from the effective date of the HAF Financial Assistance Agreement to September 30, 2026. Obligations made by September 30, 2026 must be liquidated during the award closeout period (120 calendar days after September 30, 2026) and prior to the participant’s submission of its Final Reports to Treasury by January 30, 2027. HAF participants cannot obligate HAF funds for mortgage, utility, other qualified expenses, and administrative expenses after September 30, 2026.

[3] For the limit on expenses for housing counseling and legal services pursuant to the HAF Guidance, see page 4 at https://home.treasury.gov/system/files/136/HAF-Guidance.pdf.

[4] For information on the limit for planning, community engagement, needs assessment, and administrative expenses pursuant to the HAF Guidance, see page 4 at https://home.treasury.gov/system/files/136/HAF-Guidance.pdf.

[5] For the limit on expenses for housing counseling and legal services pursuant to the HAF Guidance, see page 4 at https://home.treasury.gov/system/files/136/HAF-Guidance.pdf.

[6] Note that the Financial Assistance Agreement states: Any publications produced with funds from this award must display the following language: “This project [is being] [was] supported, in whole or in part, by federal award number [enter project FAIN] awarded to [name of Recipient] by the U.S. Department of the Treasury.